DIRECTV 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

Divestitures

Hughes Network Systems

On December 6, 2004, we announced an agreement to sell a 50% interest in a new entity that will own substantially all of the

remaining net assets of HNS, including the assets of the SPACEWAY business, to SkyTerra. The assets of the SPACEWAY

business exclude rights to the first two satellites designed for the SPACEWAY program, SPACEWAY 1 and SPACEWAY 2,

which will be used to support DIRECTV U.S.’ DTH satellite broadcasting business. The SPACEWAY assets include the rights

related to the third SPACEWAY satellite which is currently under construction, as well as rights to a contemplated fourth

SPACEWAY satellite and certain ground equipment and related intellectual property. We will retain a 50% interest in the new

company and receive $251 million in cash, which is subject to closing adjustments, and 300,000 shares of SkyTerra common

stock. Under the terms of this transaction, SkyTerra will be responsible for the day-to-day management of the new company.

We recognized a pre-tax charge of $190.6 million to “Asset impairment charges” on the Consolidated Statements of Operations

in the fourth quarter of 2004 related to this transaction. We expect the SkyTerra transaction to close in the first half of 2005 and

it is subject to certain regulatory approvals, receipt of financing and other customary closing conditions. Following the closing

of this transaction, we will no longer consolidate HNS, but rather will account for our investment under the equity method of

accounting.

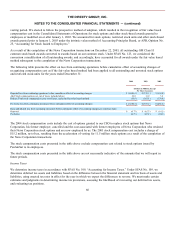

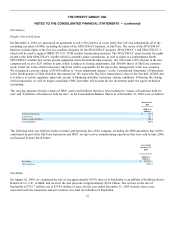

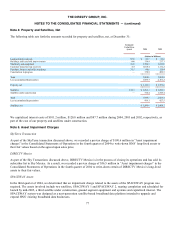

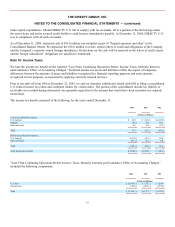

The carrying amounts of major classes of HNS’ assets and liabilities that have been included in “Assets of businesses held for

sale” and “Liabilities of businesses held for sale” on the Consolidated Balance Sheets as of December 31, 2004 were as follows:

December 31,

2004

(Dollars in

Millions)

Total current assets

$

314.3

Total assets

521.1

Total current liabilities

204.9

Total liabilities

240.6

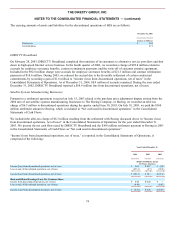

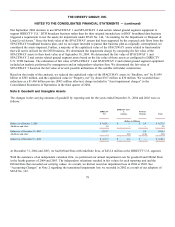

The following table sets forth pro forma revenues and operating loss of the company excluding the HNS operations that will be

contributed as part of the SkyTerra transaction and HNS’ set-top receiver manufacturing operations that were sold in June 2004,

as discussed in more detail below:

Year Ended

December 31,

2004

(Dollars in

Millions)

Revenues

$

10,437.9

Operating loss

(340.9

)

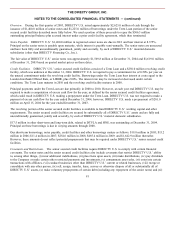

PanAmSat

On August 20, 2004, we completed the sale of our approximately 80.4% interest in PanAmSat to an affiliate of Kohlberg Kravis

Roberts & Co. L.P., or KKR, and received the sale proceeds of approximately $2.64 billion. The net loss on the sale of

PanAmSat of $723.7 million, net of $354.4 million of taxes, for the year ended December 31, 2004 includes direct costs

associated with the transaction and our retention of certain tax liabilities of PanAmSat.

72