DIRECTV 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

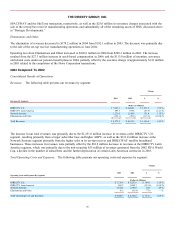

For additional information regarding the actions described above, see Note 3: Acquisitions, Divestitures and Other Transactions

and Note 5: Asset Impairment Charges of the Notes to the Consolidated Financial Statements in Item 8, Part II of this Form 10-

K, which we incorporate herein by reference.

Other Developments

In addition to the items described above, the following events had a significant effect on the comparability of our operating

results for the years ended December 31, 2004, 2003 and 2002:

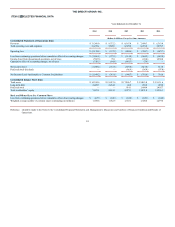

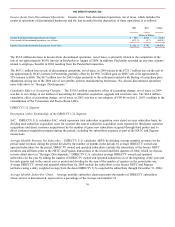

DIRECTV U.S.

Effective January 1, 2004, DIRECTV U.S. changed its method of accounting for subscriber acquisition, upgrade and retention

costs. Previously, DIRECTV U.S. deferred a portion of these costs, equal to the amount of profit to be earned from the

subscriber, typically over the 12 month subscriber contract, and amortized the deferred amounts to expense over the contract

period. DIRECTV U.S. now expenses all subscriber acquisition, upgrade and retention costs as incurred as subscribers activate

the DIRECTV service. See “Accounting Changes” in Note 2 of the Notes to the Consolidated Financial Statements in Item 8,

Part II of this Form 10-K for additional information.

DIRECTV U.S. is amortizing the subscriber related intangible asset of $951.3 million that resulted from the Pegasus transaction

over the estimated average subscriber lives of five years and the subscriber related intangible asset of $385.5 million that

resulted from the NRTC transaction over the estimated average subscriber lives of six years. Had the estimated average

subscriber lives for these intangible assets been decreased by one year, future annual amortization expense would be

approximately $60 million higher, and DIRECTV U.S. would have recorded approximately $24 million of additional

amortization expense in 2004.

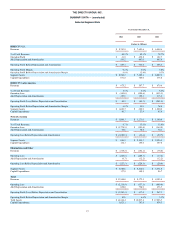

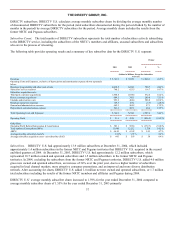

On June 4, 2002, DIRECTV U.S. and General Electric Capital Corporation, or GECC, executed an agreement to settle, for $180

million, a claim arising from a contractual arrangement whereby GECC managed a credit program for consumers who

purchased DIRECTV programming and related hardware. As a result, in 2002, we increased the provision for loss related to this

matter by $122.0 million, of which we recorded $48.0 million as a charge to “General and administrative expenses” and $74.0

million as a charge to “Interest expense” in the Consolidated Statements of Operations.

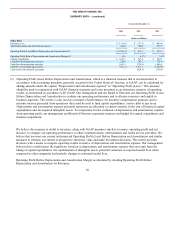

DIRECTV Latin America

As part of the Sky Transactions, DTVLA recorded $8.5 million of severance and other costs related to the ongoing shut-down

of DIRECTV Mexico.

On March 18, 2003, DLA LLC filed a voluntary petition for reorganization under Chapter 11 of the U.S. Bankruptcy Code. In

February 2004, DLA LLC announced the confirmation of its Plan of Reorganization by the U.S. Bankruptcy Court and its

emergence from Chapter 11. As a result of the bankruptcy proceedings described in more detail in Note 18 of the Notes to the

Consolidated Financial Statements in Item 8, Part II, DTVLA experienced reduced programming costs in 2004 and 2003 due to

the rejection or renegotiation of certain programming contracts.

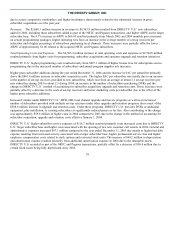

On July 1, 2003, as more fully discussed in Note 2 of the Notes to the Consolidated Financial Statements in Item 8, Part II,

DTVLA began consolidating the Venezuelan and Puerto Rican LOCs with the adoption of Financial Accounting Standards

Board, or FASB, Interpretation No. 46 (revised December 2003), “Consolidation of Variable Interest Entities—an interpretation

of ARB No. 51,” or FIN 46. Prior to July 1, 2003, DTVLA accounted for its investments in the Venezuelan and Puerto Rican

LOCs under the equity method of accounting and reflected approximately 75.0% of their net income or loss in “Other, net” in

the Consolidated Statements of Operations.

30