DIRECTV 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

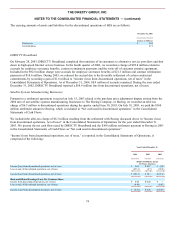

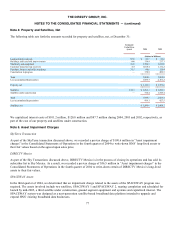

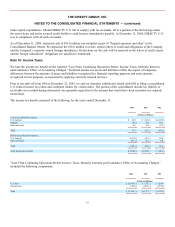

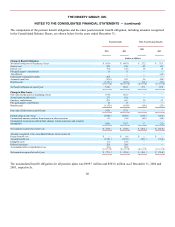

Note 4: Property and Satellites, Net

The following table sets forth the amounts recorded for property and satellites, net, at December 31:

Estimated

Useful Lives

(years)

2004

2003

(Dollars in Millions)

Land and improvements

9-30

$

25.7

$

41.4

Buildings and leasehold improvements

1-40

174.9

237.3

Machinery and equipment

3-24

1,598.3

1,833.0

Customer leased set-top receivers

4-5

1,018.4

1,172.2

Furniture, fixtures and office machines

3-15

98.6

119.4

Construction in progress

—

178.9

489.5

Total

3,094.8

3,892.8

Less accumulated depreciation

1,959.7

2,101.2

Property, net

$

1,135.1

$

1,791.6

Satellites

12-16

$

1,265.1

$

1,290.3

Satellites under construction

—

714.4

1,545.4

Total

1,979.5

2,835.7

Less accumulated depreciation

419.1

427.5

Satellites, net

$

1,560.4

$

2,408.2

We capitalized interest costs of $101.2 million, $120.0 million and $87.7 million during 2004, 2003 and 2002, respectively, as

part of the cost of our property and satellites under construction.

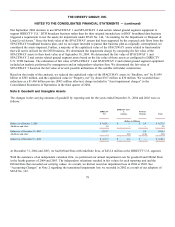

Note 5. Asset Impairment Charges

SkyTerra Transaction

As part of the SkyTerra transaction discussed above, we recorded a pre-tax charge of $190.6 million in “Asset impairment

charges” in the Consolidated Statements of Operations in the fourth quarter of 2004 to write-down HNS’ long-lived assets to

their fair values based on the agreed upon sales price.

DIRECTV Mexico

As part of the Sky Transactions discussed above, DIRECTV Mexico is in the process of closing its operations and has sold its

subscriber list to Sky Mexico. As a result, we recorded a pre-tax charge of $36.5 million in “Asset impairment charges” in the

Consolidated Statements of Operations in the fourth quarter of 2004 to write-down certain of DIRECTV Mexico’s long-lived

assets to their fair values.

SPACEWAY Assets

In the third quarter of 2004, we determined that an impairment charge related to the assets of the SPACEWAY program was

required. The assets involved include two satellites, SPACEWAY 1 and SPACEWAY 2, nearing completion and scheduled for

launch by mid-2005, a third satellite under construction, ground segment equipment and systems and capitalized interest. The

SPACEWAY system was designed as a next-generation satellite-based broadband data platform intended to upgrade and

expand HNS’ existing broadband data businesses.

77