DIRECTV 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

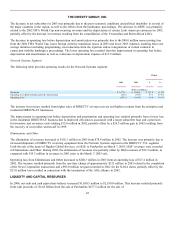

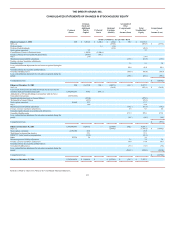

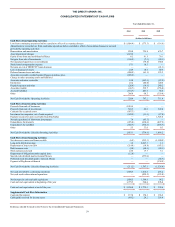

THE DIRECTV GROUP, INC.

balance of $503.9 million as a cumulative effect of accounting change. The amount of the cumulative effect was $310.5 million,

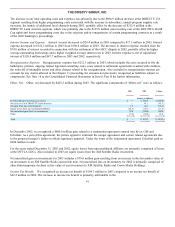

net of taxes. The following table presents our results on a pro forma basis as if we had retroactively applied this new method:

2004

2003

2002

(Dollars in Millions, Except Per Share

and Per Subscriber Amounts)

Pro Forma:

Total operating costs and expenses

$

13,479.4

$

9,599.0

$

8,712.0

Operating loss

(2,119.4

)

(226.8

)

(526.6

)

Net loss attributable to common stockholders

(1,638.7

)

(416.8

)

(1,010.4

)

Basic and diluted net loss per common share

(1.18

)

(0.30

)

(0.75

)

Other Data:

Operating loss

$

(2,119.4

)

$

(226.8

)

$

(526.6

)

Add: Depreciation and amortization expense

838.0

754.9

676.7

Operating profit (loss) before depreciation and amortization

$

(1,281.4

)

$

528.1

$

150.1

Average subscriber acquisition costs—per subscriber (SAC)

$

643

$

604

$

570

For addition information regarding “Accounting Changes,” see Note 2 of the Notes to the Consolidated Financial Statements in

Item 8, Part II of this Form 10-K, which we incorporate herein by reference.

SECURITY RATINGS

Debt ratings by the various rating agencies reflect each agency’s opinion of the ability of issuers to repay debt obligations as

they come due. Ratings in the Ba range generally indicate moderate protection of interest and principal payments, potentially

outweighed by exposure to uncertainties or adverse conditions for Moody’s Investor Services, or Moody’s, and the BB range

for Standard & Poor’s Ratings Services, or S&P. Ratings in the B range generally indicate that the obligor currently has

financial capacity to meet its financial commitments but there is limited assurance over any long period of time that interest and

principal payments will be made or that other terms will be maintained. In general, lower ratings result in higher borrowing

costs. A security rating is not a recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at

any time by the assigning rating organization.

The Company

Effective January 24, 2005, Moody’s no longer provides a security rating for us, consistent with its normal practice of providing

a rating for only the primary debt issuer. Accordingly, Moody’s provides security ratings only at the DIRECTV U.S. level, as

described below.

On August 9, 2004, S&P affirmed its ratings on our long-term corporate rating of BB, removed the ratings from CreditWatch

and assigned a positive outlook. On February 2, 2005, S&P affirmed the ratings and revised the outlook to stable, citing

potential share repurchase activity while discretionary cash flow was negative.

DIRECTV U.S.

On April 20, 2004, Moody’s placed the long-term debt ratings for DIRECTV U.S. on review for possible upgrade, following

the announcement of the sale of our interest in PanAmSat to an affiliate of KKR. On January 24, 2005, Moody’s concluded its

review and raised DIRECTV U.S.’ senior implied rating from Ba3 to Ba2,

51