DIRECTV 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

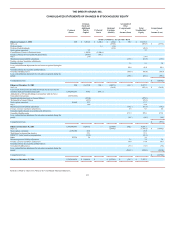

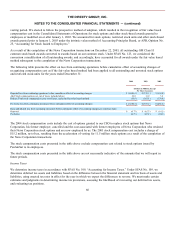

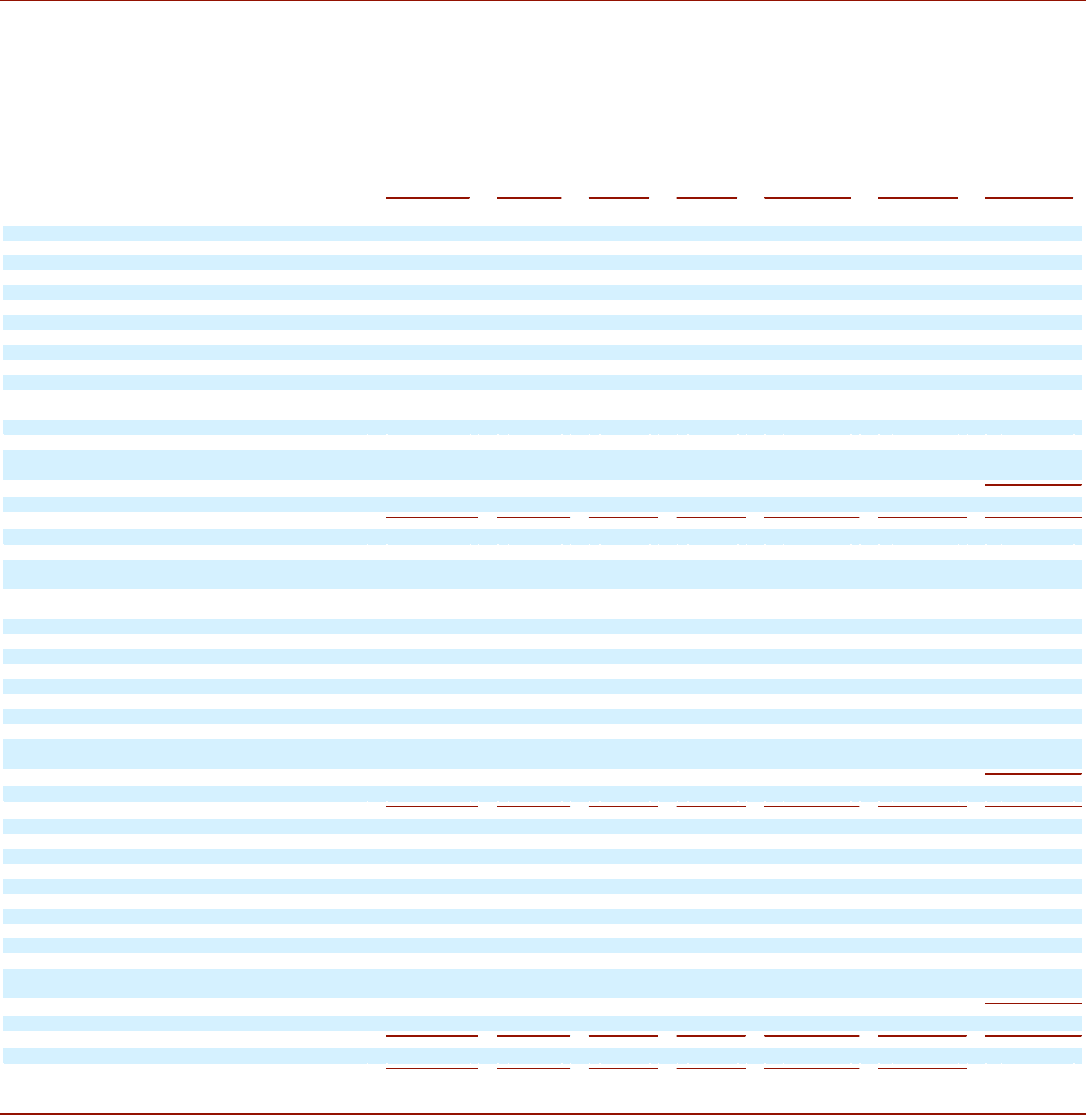

THE DIRECTV GROUP, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

Common

Shares

Common

Stock and

Additional

Paid-In

Capital

Preferred

Stock

Retained

Earnings

(Deficit)

Accumulated

Other

Comprehensiv

e

Income (Loss)

Total

Stockholders’

Equity

Comprehensiv

e

Income (Loss)

(Dollars in Millions, Except Share Data)

Balance at January 1, 2002

200

$

9,561.2

$

1,498.4

$

(86.4

)

$

98.7

$

11,071.9

Net Loss

(893.8

)

(893.8

)

$

(893.8

)

Preferred stock

1.6

(1.6

)

Preferred stock dividends

(45.3

)

(45.3

)

Stock options exercised

7.7

7.7

Cancellation of Series A Preferred Stock

1,500.0

(1,500.0

)

Issuance of Series B Convertible Preferred Stock

(914.1

)

914.1

Other

(3.0

)

(3.0

)

Minimum pension liability adjustment

(15.0

)

(15.0

)

(15.0

)

Foreign currency translation adjustments:

Unrealized gains

1.6

1.6

1.6

Less: reclassification adjustment for net losses recognized during the

period

48.9

48.9

48.9

Unrealized losses on securities and derivatives:

Unrealized holding losses

(96.8

)

(96.8

)

(96.8

)

Less: reclassification adjustment for net gains recognized during the

period

(99.1

)

(99.1

)

(99.1

)

Comprehensive loss

$

(1,054.2

)

Balance at December 31, 2002

200

10,151.8

914.1

(1,027.1

)

(61.7

)

9,977.1

Net Loss

(361.8

)

(361.8

)

$

(361.8

)

Conversion of Series B Convertible Preferred Stock into Class B

common stock and common stock split

1,481,891,553

914.1

(914.1

)

Adjustment to GM stock holdings in connection with the News

Corporation transactions

(98,301,304

)

Special cash dividend paid to General Motors

(275.0

)

(275.0

)

Tax benefit to General Motors

(25.1

)

(25.1

)

Stock options exercised

59,002

17.7

17.7

Other

34.0

34.0

Minimum pension liability adjustment

(16.5

)

(16.5

)

(16.5

)

Foreign currency translation adjustments

6.0

6.0

6.0

Unrealized gains (losses) on securities and derivatives:

Unrealized holding gains

275.3

275.3

275.3

Less: reclassification adjustment for net gains recognized during the

period

(0.6

)

(0.6

)

(0.6

)

Comprehensive loss

$

(97.6

)

Balance at December 31, 2003

1,383,649,451

10,817.5

—

(1,388.9

)

202.5

9,631.1

Net Loss

(1,949.2

)

(1,949.2

)

$

(1,949.2

)

Stock options exercised

2,139,782

23.0

23.0

Stock-based compensation expense

57.1

57.1

DIRECTV Latin America reorganization

(31.5

)

(31.5

)

Other

25,226

3.8

3.8

Minimum pension liability adjustment

7.4

7.4

7.4

Foreign currency translation adjustments

14.8

14.8

14.8

Unrealized losses on securities and derivatives:

Unrealized holding losses

(5.6

)

(5.6

)

(5.6

)

Less: reclassification adjustment for net gains recognized during the

period

(243.8

)

(243.8

)

(243.8

)

Comprehensive loss

$

(2,176.4

)

Balance at December 31, 2004

1,385,814,459

$

10,869.9

$

—

$

(3,338.1

)

$

(24.7

)

$

7,507.1

Reference should be made to the Notes to the Consolidated Financial Statements.

57