DIRECTV 2004 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

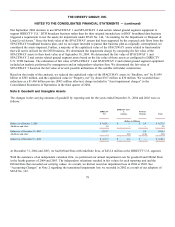

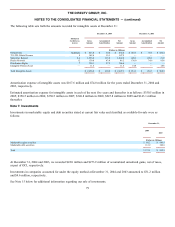

Goodwill and Other Intangible Assets. We adopted SFAS No. 142, “Goodwill and Other Intangible Assets” on January 1,

2002. As a result of completing the required transitional impairment test, we determined that the carrying value of reporting unit

goodwill exceeded the fair value of that goodwill and that all of the goodwill recorded at DTVLA and DIRECTV Broadband,

$631.8 million and $107.9 million, respectively, was impaired. In the fourth quarter of 2002, we also recorded a $16.0 million

charge representing our share of the goodwill impairment of an equity method investee. As a result, we recorded a charge to

“Cumulative effect of accounting changes, net of taxes,” of $681.3 million ($755.7 million pre-tax) as of January 1, 2002 in the

Consolidated Statements of Operations.

New Accounting Standards

In December 2004, the FASB issued SFAS No. 123 (revised 2004), “Share-Based Payment,” or SFAS No. 123R. SFAS No.

123R, which replaces SFAS No. 123 and supersedes APB Opinion No. 25, requires that compensation cost relating to share-

based payment transactions be recognized in the financial statements, based on the fair value of the equity or liability

instruments issued. SFAS No. 123R is effective as of the beginning of the first interim or annual reporting period that begins

after June 15, 2005 and applies to all awards granted, modified, repurchased or cancelled after the effective date. We do not

expect the adoption of this standard to have a significant impact on our consolidated results of operations or financial position.

In December 2004, the FASB issued SFAS No. 153, “Exchanges of Nonmonetary Assets—an amendment of APB Opinion No.

29,” or SFAS No. 153. SFAS No. 153 eliminates the exception for nonmonetary exchanges of similar productive assets of APB

Opinion No. 29 and replaces it with a general exception for exchanges of nonmonetary assets that do not have commercial

substance. A nonmonetary exchange has commercial substance if the future cash flows of the entity are expected to change

significantly as a result of the exchange. SFAS No. 153 is effective for nonmonetary asset exchanges occurring in fiscal periods

beginning after June 15, 2005. We do not expect the adoption of this standard to have a significant impact on our consolidated

results of operations or financial position.

In November 2004, the FASB issued SFAS No. 151, “Inventory Costs—an amendment of ARB No. 43, Chapter 4,” or SFAS

No. 151. SFAS No. 151 amends ARB No. 43, Chapter 4, “Inventory Pricing,” to clarify the accounting for idle facility expense,

freight, handling costs and wasted material. SFAS No. 151 requires that these types of costs be recognized as current period

expenses. SFAS No. 151 is effective for inventory costs incurred during fiscal years beginning after June 15, 2005. We do not

expect the adoption of this standard to have a significant impact on our consolidated results of operations or financial position.

Note 3: Acquisitions, Divestitures and Other Transactions

Acquisitions

Sky Transactions

On October 8, 2004, we entered into a series of transactions with News Corporation, Televisa, Globo and Liberty that provide

for the Sky Transactions. The Sky Transactions are designed to strengthen the operating and financial performance of DTVLA

by consolidating the DTH platforms of DTVLA and Sky Latin America into a single platform in each of the major territories

served in the region. Total cash consideration for the equity interests in the Sky Latin America platforms is approximately $580

million, of which we paid $398 million in October 2004. The remainder is subject to adjustment and will be paid at the

completion of the transactions.

In Brazil, DIRECTV Brasil and Sky Brasil have agreed to merge, with our DIRECTV Brasil customers migrating to the Sky

Brasil platform. In addition, we intend to acquire the interests of News Corporation and

69