DIRECTV 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

purchase agreement with Thomson for the supply of set-top receivers. The proceeds in excess of the book value of the

HNS assets sold of approximately $200 million have been deferred and will be recognized as set-top receivers

purchased from Thomson under the contract are activated.

•

On August 20, 2004, we completed the sale of our approximately 80.4% interest in PanAmSat to an affiliate of

Kohlberg Kravis Roberts & Co. L.P., or KKR, for about $2.64 billion in cash. We recorded a $723.7 million loss on

the sale of PanAmSat, net of taxes, in 2004.

•

In 2004, HNS completed the sale of its approximately 55% ownership interest in HSS to Flextronics for $226.5 million

in cash. We received $226.5 million on June 11, 2004 and recognized an after-tax gain of approximately $90.7 million

($176.1 million pre-tax) in 2004.

•

On December 6, 2004, we announced an agreement to sell a 50% interest in a new entity that will own substantially all

of the remaining net assets of HNS, including the assets of the SPACEWAY business, to SkyTerra. The assets of the

SPACEWAY business exclude rights to the first two satellites designed for the SPACEWAY program, SPACEWAY 1

and SPACEWAY 2, which will be used to support DIRECTV U.S.’ DTH satellite broadcasting business. The

SPACEWAY assets include the rights related to the third SPACEWAY satellite which is currently under construction,

as well as rights to a contemplated fourth SPACEWAY satellite and certain ground equipment and related intellectual

property. We will retain a 50% interest in the new company and receive $251 million in cash, which is subject to

closing adjustments, and 300,000 shares of SkyTerra common stock. Under the terms of this transaction, SkyTerra will

be responsible for the day-to-day management of the new company. We recorded a pre-tax charge of $190.6 million to

“Asset impairment charges” in the Consolidated Statements of Operations in the fourth quarter of 2004 related to this

transaction. As a result of the SkyTerra transaction, we will record a charge of approximately $50 million in 2005 for

lease termination obligations and pension settlement and related costs. We expect the SkyTerra transaction to close in

the first half of 2005 and it is subject to certain regulatory approvals, receipt of financing and other customary closing

conditions. Following the close of this transaction, we will no longer consolidate HNS, but rather will account for our

investment under the equity method of accounting.

The financial results for PanAmSat, which formerly comprised our Satellite Services segment, HSS, which formerly was a

component of the Network Systems segment, and DIRECTV Broadband, our high-speed Internet services business that we shut

down in February 2003, are presented in the Consolidated Statements of Operations as discontinued operations.

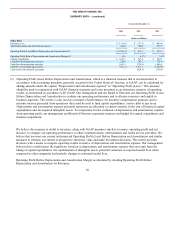

Asset Impairment Charges

•

In the third quarter of 2004, we decided to utilize the SPACEWAY 1 and SPACEWAY 2 satellites and certain related

ground segment equipment to support DIRECTV U.S.’ DTH broadcast business. This decision to no longer use these

assets for the SPACEWAY broadband business triggered an impairment test of our investment in the SPACEWAY

assets. As a result of this test, we determined that the fair value of the SPACEWAY satellites and ground segment

equipment for their alternative use exceeded their book value by $1.466 billion. Accordingly, we recorded a charge in

“Asset impairment charges” in the Consolidated Statements of Operations in the third quarter of 2004.

•

As part of the Sky Transactions, DIRECTV Mexico is in process of closing its operations and has sold its subscriber

list to Sky Mexico. As a result, we recorded a pre-tax charge of $36.5 million in “Asset impairment charges” in the

Consolidated Statements of Operations in the fourth quarter of 2004 to write-down certain of DIRECTV Mexico’s

long-lived assets to their fair values.

•

As part of the SkyTerra transaction discussed above, we recorded a pre-tax charge of $190.6 million in “Asset

impairment charges” in the Consolidated Statements of Operations in the fourth quarter of 2004 to write-down HNS’

long-lived assets to their fair values based on the agreed upon sales price.

29