DIRECTV 2004 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

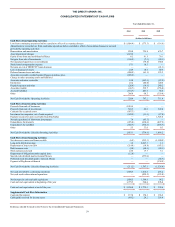

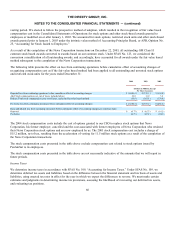

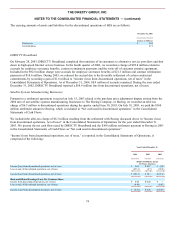

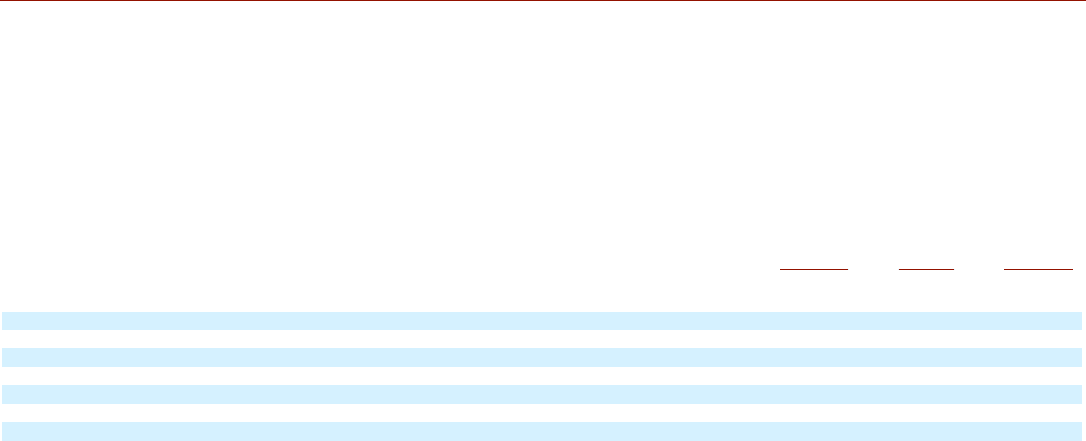

The following table sets forth our loss from continuing operations before cumulative effect of accounting changes and net loss

attributable to common stockholders on a pro forma basis as if the change in accounting for subscriber acquisition, upgrade and

retention costs had been applied retroactively:

2004

2003

2002

(Dollars in Millions, Except

Per Share Amounts)

Reported loss from continuing operations before cumulative effect of accounting changes

$

(1,056.4

)

$

(375.3

)

$

(114.9

)

Reported basic and diluted loss per common share

(0.77

)

(0.27

)

(0.12

)

Pro forma loss from continuing operations

(1,056.4

)

(430.3

)

(184.6

)

Pro forma basic and diluted loss per common share

(0.77

)

(0.31

)

(0.17

)

Reported net loss attributable to common stockholders

(1,949.2

)

(361.8

)

(940.7

)

Reported basic and diluted loss per common share

(1.41

)

(0.26

)

(0.70

)

Pro forma net loss attributable to common stockholders

(1,638.7

)

(416.8

)

(1,010.4

)

Pro forma basic and diluted loss per common share

(1.18

)

(0.30

)

(0.75

)

Revenue Recognition. In November 2002, the Emerging Issues Task Force, or EITF, reached a consensus on Issue No. 00-21,

“Accounting for Revenue Arrangements with Multiple Deliverables.” EITF Issue No. 00-21 requires the allocation of revenues

into separate units of accounting for transactions that involve more than one deliverable and contain more than one unit of

accounting. We elected to apply the accounting required by EITF Issue No. 00-21 prospectively to transactions entered into

after June 30, 2003. The adoption of this standard did not have a significant impact on our consolidated results of operations or

financial position.

Variable Interest Entities. In January 2003, the Financial Accounting Standards Board, or FASB, issued Interpretation No. 46

(revised December 2003), “Consolidation of Variable Interest Entities—an interpretation of ARB No. 51,” or FIN 46. FIN 46

requires the consolidation of a variable interest entity, or VIE, where an equity investor achieves a controlling financial interest

through arrangements other than voting interests, and it is determined that the investor will absorb a majority of the expected

losses and/or receive the majority of residual returns of the VIE. We applied this interpretation beginning on July 1, 2003 for

entities created prior to February 1, 2003. We determined that the partially-owned LOCs providing DIRECTV programming

services in Venezuela and Puerto Rico, of which we owned 19.5% and 40.0%, respectively, are VIEs. As a result, on July 1,

2003, we began consolidating the Venezuelan and Puerto Rican LOCs resulting in an increase in total assets of $55.1 million,

which included $29.1 million of cash. The adoption of this interpretation resulted in us recording an after-tax charge of $64.6

million to cumulative effect of accounting changes in the Consolidated Statements of Operations.

Prior to July 1, 2003, we accounted for our investments in the Venezuelan and Puerto Rican LOCs under the equity method of

accounting and, through June 30, 2003, reflected approximately 75.0% of their net income or loss in “Other, net” in the

Consolidated Statements of Operations due to the accumulation of net losses in excess of other investors’ investments.

Stock-Based Compensation. As discussed above, beginning on January 1, 2003, we adopted the fair value based method of

accounting for stock-based employee compensation of SFAS No. 123, “Accounting for Stock-Based Compensation” as

amended by SFAS No. 148, “Accounting for Stock-Based Compensation—Transition and Disclosure—an Amendment of

SFAS No. 123.” Under this method, compensation expense equal to the fair value of the stock-based award at grant is

recognized over the course of its vesting period. We elected to follow the prospective method of adoption, which resulted in the

recognition of fair value based compensation cost in the Consolidated Statements of Operations for stock options and other

stock-based awards granted to employees or modified on or after January 1, 2003.

68