DIRECTV 2004 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

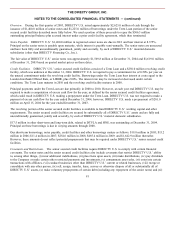

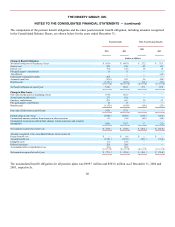

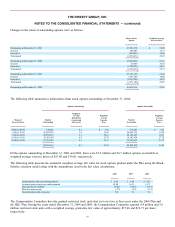

Other Comprehensive Income

The following represents changes in the components of OCI, net of taxes, as of December 31:

2004

2003

2002

Pre-tax

Amount

Tax

(Benefit

)

Expense

Net

Amount

Pre-tax

Amount

Tax

(Benefit)

Expense

Net

Amount

Pre-tax

Amount

Tax

Benefit

Net

Amount

(Dollars in Millions)

Minimum pension liability adjustments

$

11.4

$

4.0

$

7.4

$

(24.4

)

$

(7.9

)

$

(16.5

)

$

(25.2

)

$

(10.2

)

$

(15.0

)

Foreign currency translation adjustments:

Unrealized gains

14.8

—

14.8

6.0

—

6.0

1.6

—

1.6

Less: reclassification adjustment for net losses

recognized during the period

—

—

—

—

—

—

48.9

—

48.9

Unrealized gains (losses) on securities and derivatives:

Unrealized holding gains (losses)

(9.1

)

(3.5

)

(5.6

)

446.8

171.5

275.3

(162.6

)

(65.8

)

(96.8

)

Less: reclassification adjustment for net gains recognized

during the period

(243.8

)

—

(243.8

)

(0.6

)

—

(0.6

)

(162.8

)

(63.7

)

(99.1

)

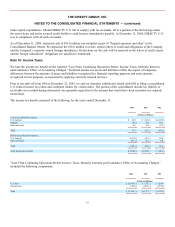

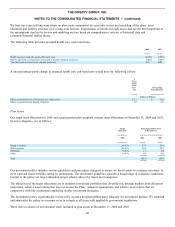

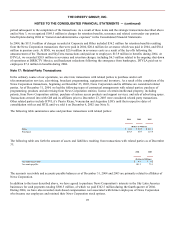

Note 13: Earnings (Loss) Per Common Share

We compute Basic Earnings (Loss) Per Common Share, or EPS, by dividing net income (loss) attributable to common

stockholders by the weighted average number of common shares outstanding for the period. Income (loss) from continuing

operations before cumulative effect of accounting changes attributable to common stockholders for each period includes income

(loss) from continuing operations before cumulative effect of accounting changes less dividends on preferred stock for the

purpose of computing EPS.

Diluted EPS considers the effect of common equivalent shares, which we exclude from the computation in loss periods as their

effect would be antidilutive. Our existing common equivalent shares consist entirely of common stock options and restricted

stock units issued to employees. We exclude 88.9 million common stock options and 7.8 million restricted stock units for the

year ended December 31, 2004 and 91.2 million common stock options and 3.6 million restricted stock units for the year ended

December 31, 2003 from the calculation of diluted EPS because they were antidilutive. For the year ended December 31, 2002,

we excluded 95.1 million common stock options from the calculation of diluted EPS because they were antidilutive. We also

excluded shares issuable upon conversion of our Series A Preferred Stock prior to the date of actual conversion because they

were antidilutive.

For purposes of calculating EPS, we calculate the weighted average number of common shares outstanding using the number of

our common shares outstanding beginning on December 23, 2003 and the number of shares in the GM Class H Dividend Base

prior to December 23, 2003. The GM Class H Dividend Base is equal to the number of shares of GM Class H common stock

which, if issued and outstanding, would represent 100% of the tracking stock interest in our earnings.

91