DIRECTV 2004 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

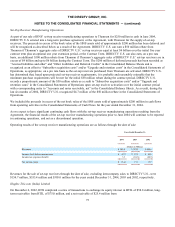

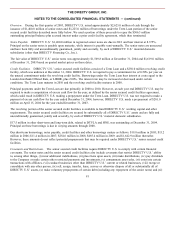

HTIL’s Indian sponsor, Ispat, in exchange for investments in Tata Teleservices Limited, or TTSL. We accounted for the

transactions for as a sale of the assets surrendered at their fair values and the purchase of the instruments in TTSL on the date of

the transactions. HNS allocated the fair value of the assets surrendered of $135.1 million to the assets received, which included

redeemable preference shares ($110.1 million), a 15 year zero coupon note ($9.7 million) and 50 million common stock

purchase warrants ($15.3 million), based on their relative fair values. The preference shares are redeemable at the end of 51 or

75 months at the option of HNS and convertible to common equity at the end of 75 months at the option of HNS. The

redemption is guaranteed in the form of a put to TTSL’s parent company, Tata Sons. The preference shares are carried at fair

value as an available-for-sale security, with unrealized gains and losses reported net of tax, as a component of OCI.

In connection with this exchange, HNS recognized an after-tax loss of approximately $14.1 million, which is comprised of a

pre-tax loss recognized in “Other, net” in the Consolidated Statements of Operations of $52.1 million, based on the difference

between fair value and carrying value of the assets surrendered and the requirement to recognize cumulative translation

adjustments of $28.0 million associated with the HTIL investment, which were offset by an approximate $38.0 million tax

benefit which includes the tax benefit from equity method losses that were not previously recognized for tax purposes.

Earlier in 2002, HNS recognized a loss on the receivable from Ispat described above when it was required to honor a $54.4

million loan guarantee. The receivable was immediately reduced to its estimated net realizable value of $25.4 million through a

charge to “Other, net” in the Consolidated Statements of Operations of $29.0 million.

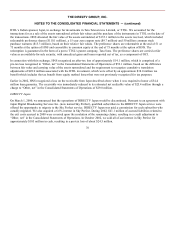

DIRECTV Japan

On March 1, 2000, we announced that the operations of DIRECTV Japan would be discontinued. Pursuant to an agreement with

Japan Digital Broadcasting Services Inc. (now named Sky Perfect), qualified subscribers to the DIRECTV Japan service were

offered the opportunity to migrate to the Sky Perfect service. DIRECTV Japan was paid a commission for each subscriber who

actually migrated. We also acquired a 6.6% interest in Sky Perfect. During 2002, $41.1 million of accrued liabilities related to

the exit costs accrued in 2000 were reversed upon the resolution of the remaining claims, resulting in a credit adjustment to

“Other, net” in the Consolidated Statements of Operations. In October 2002, we sold all of our interest in Sky Perfect for

approximately $105 million in cash, resulting in a pre-tax loss of about $24.5 million.

76