DIRECTV 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

Liberty in Sky Brasil upon completion, acquiring in excess of 70% of the merged platform. The transactions in Brazil are

subject to local regulatory approval which has been requested but not yet granted. We intend to consolidate the operations of

Sky Brasil only upon receipt of approval from the appropriate regulatory bodies. If we do not obtain required regulatory

approvals, we may consider selling or shutting down DIRECTV Brasil with the expectation that following such an alternative

transaction, we would be able to obtain regulatory approval to purchase the interests of News Corporation and Liberty in Sky

Brasil.

In Mexico, DTVLA’s local affiliate is in the process of closing its operations and has sold its subscriber list to Sky Mexico. In

addition, we will acquire the interest of News Corporation and, jointly with Televisa, the interest of Liberty in Sky Mexico. We

will receive up to a 15% equity interest in Sky Mexico as consideration for DIRECTV Mexico’s subscriber list, which is

expected to occur in late 2005. The amount of equity we expect to receive is impacted by the successful migration and retention

of DIRECTV Mexico’s subscribers to Sky Mexico and is subject to final verification. Upon consummation of these

transactions, we anticipate having an equity interest of approximately 43% in Sky Mexico, which will not be a controlling

interest.

In the rest of the region, we have acquired the interests of News Corporation and Liberty and have agreed to acquire the

interests of Globo and Televisa in Sky Multi-Country Partners and certain related businesses, or PanAmericana, which own

DTH platforms in Colombia and Chile. DTVLA intends to migrate the Sky Colombia and Sky Chile subscribers to the DTVLA

platform in 2005. However, the transaction in Colombia is subject to local regulatory approval.

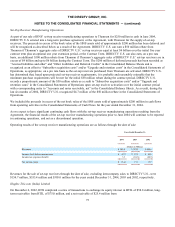

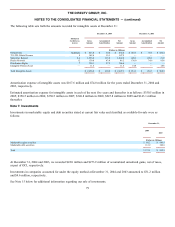

The cash consideration of approximately $580.0 million relates to the acquisition of the News Corporation’s and Liberty’s

interests in Sky Brasil and Sky Mexico for approximately $362.0 million and $315.0 million, respectively, offset by the

assumption of Sky’s PanAmericana entities’ net liabilities of approximately $91.9 million. In the fourth quarter of 2004, we

paid approximately $398.0 million of the total cash consideration, principally related to the prepayment of the Sky Brasil

interests. The prepayments made by us related specifically to our acquisition of the Sky Brasil interests must be refunded by

News Corporation should the transactions be terminated due to the inability to obtain local regulatory approval. We will

consolidate the operations of Sky Brasil and have agreed to guarantee all of Sky Brasil’s approximately $210.0 million of

outstanding bank debt as well as all of their long-term transponder obligations upon receipt of local regulatory approval. We

will not consolidate the operations of Sky Mexico, however, upon successful completion of the transaction, we have agreed to

guarantee our attributable share of approximately $88.0 million of bank debt as well as our attributable share of their long-term

transponder obligations in proportion to our ownership percentage. We began consolidating Sky’s PanAmericana entities on

October 8, 2004 and have recorded approximately $12.4 million of goodwill based on our preliminary allocation of purchase

price, which is subject to adjustment. We have recorded the prepaid amounts and the present value of News Corporation’s

future reimbursement related to our assumption of certain liabilities of Sky’s PanAmericana entities in “Investments and Other

Assets” in our Consolidated Balance Sheets as of December 31, 2004.

Darlene Investments LLC, or Darlene, has filed suit alleging fraud, self-dealing and violation of fiduciary, contractual and other

duties against us and certain of our subsidiaries (including DLA LLC), News Corporation and others seeking, among other

things, injunctive relief to preclude the consummation of the Sky Transactions. See Note 21 for more information regarding this

case.

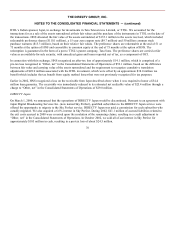

NRTC Contract Rights

On June 2, 2004, DIRECTV U.S. and the National Rural Telecommunications Cooperative, or NRTC, announced an

agreement, effective June 1, 2004, to end the NRTC’s exclusive DIRECTV service distribution

70