DIRECTV 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

Cash Flows

Contributions

We expect to contribute approximately $14.5 million and $34.8 million to our qualified and nonqualified pension plans,

respectively, in 2005.

Estimated Future Benefit Payments

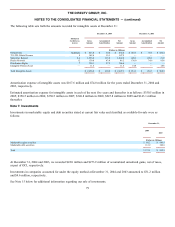

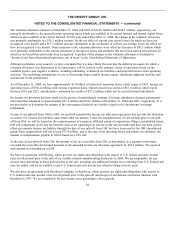

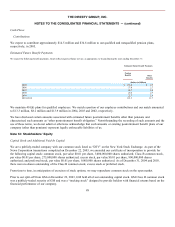

We expect the following benefit payments, which reflect expected future service, as appropriate, to be paid during the years ending December 31:

Estimated Future Benefit Payments

Pension

Benefits

Other

Benefits

(Dollars in Millions)

2005

$

153.0

$

2.7

2006

37.0

2.7

2007

28.7

2.8

2008

25.4

2.7

2009

22.7

2.6

2010-2014

121.3

11.7

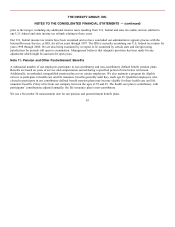

We maintain 401(k) plans for qualified employees. We match a portion of our employee contributions and our match amounted

to $13.3 million, $8.2 million and $13.9 million in 2004, 2003 and 2002, respectively.

We have disclosed certain amounts associated with estimated future postretirement benefits other than pensions and

characterized such amounts as “other postretirement benefit obligation.” Notwithstanding the recording of such amounts and the

use of these terms, we do not admit or otherwise acknowledge that such amounts or existing postretirement benefit plans of our

company (other than pensions) represent legally enforceable liabilities of us.

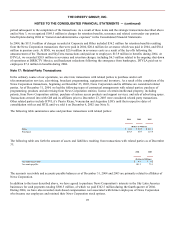

Note 12: Stockholders’ Equity

Capital Stock and Additional Paid-In Capital

We are a publicly-traded company with our common stock listed as “DTV” on the New York Stock Exchange. As part of the

News Corporation transactions completed on December 22, 2003, we amended our certificate of incorporation to provide for

the following capital stock: common stock, par value $0.01 per share, 3,000,000,000 shares authorized; Class B common stock,

par value $0.01 per share, 275,000,000 shares authorized; excess stock, par value $0.01 per share, 800,000,000 shares

authorized; and preferred stock, par value $0.01 per share, 9,000,000 shares authorized. As of December 31, 2004 and 2003,

there were no shares outstanding of the Class B common stock, excess stock or preferred stock.

From time to time, in anticipation of exercises of stock options, we may repurchase common stock on the open market.

Prior to our split-off from GM on December 22, 2003, GM held all of our outstanding capital stock. GM Class H common stock

was a publicly-traded security of GM and was a “tracking stock” designed to provide holders with financial returns based on the

financial performance of our company.

89