DIRECTV 2004 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

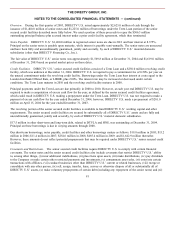

prior to the merger, including any additional income taxes resulting from U.S. federal and state tax audits, and are entitled to

any U.S. federal and state income tax refunds relating to those years.

Our U.S. federal income tax returns have been examined and we have concluded our administrative appeals process with the

Internal Revenue Service, or IRS, for all tax years through 1997. The IRS is currently examining our U.S. federal tax returns for

years 1998 through 2000. We are also being examined by or expect to be examined by certain state and foreign taxing

jurisdictions for periods still open to examination. Management believes that adequate provision has been made for any

adjustment which might be assessed for open years.

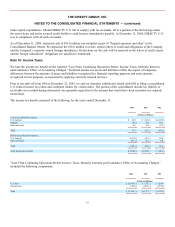

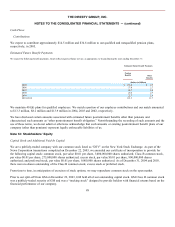

Note 11: Pension and Other Postretirement Benefits

A substantial number of our employees participate in our contributory and non-contributory defined benefit pension plans.

Benefits are based on years of service and compensation earned during a specified period of time before retirement.

Additionally, an unfunded, nonqualified pension plan covers certain employees. We also maintain a program for eligible

retirees to participate in health care and life insurance benefits generally until they reach age 65. Qualified employees who

elected to participate in our contributory defined benefit pension plans may become eligible for these health care and life

insurance benefits if they retire from our company between the ages of 55 and 65. The health care plan is contributory with

participants’ contributions adjusted annually; the life insurance plan is non-contributory.

We use a November 30 measurement date for our pension and postretirement benefit plans.

85