DIRECTV 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

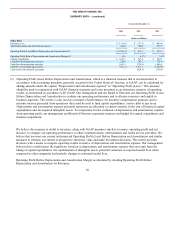

In 2001, DTVLA secured a contract for the exclusive rights to broadcast and re-sell the FIFA World Cup soccer tournaments in

Argentina, Chile, Colombia, Mexico, Uruguay and Venezuela in 2002 and 2006. DTVLA charged the cost of the 2002 rights of

$135.0 million to operations in 2002 when the live events were broadcast. DTVLA was unable to recover the entire cost of the

programming, resulting in an $80.0 million loss on the contract in 2002. The 2006 contract was rejected in conjunction with

DLA LLC’s bankruptcy and renegotiated under substantially different terms.

DTVLA’s 2003 and 2002 operating results were adversely affected by the economic and political instability throughout Latin

America. In particular, revenues and operating profit were significantly affected by a loss in net subscribers and the ongoing

depreciation of certain local currencies.

Other

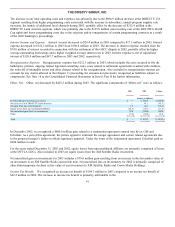

During 2004, we recognized $169.6 million in non-recurring charges for retention benefits, severance and related costs under

our pension benefit plans as a result of headcount reductions and the strategic transactions discussed above. The $113.0 million

of charges recorded at Corporate and Other included $36.2 million for retention benefits resulting from the News Corporation

transactions, $20.4 million for severance, and $56.4 million in pension costs. At HNS, we accrued $25.6 million in severance

costs as a result of the lay-offs following the announcement of the Thomson and SkyTerra transactions. At DTVLA, we

recorded $20.9 million in severance and retention charges, including $6.3 million related to the ongoing shut-down of

operations at DIRECTV Mexico, and headcount reductions following the emergence from bankruptcy. See “Strategic

Developments—Divestitures” above for more information regarding these transactions and Note 16 of the Notes to the

Consolidated Financial Statements in Item 8, Part II for more information regarding our charge related to severance, retention

and other related costs under our pension benefits plans.

On June 2, 2004, we obtained stockholder approval for The DIRECTV Group, Inc. 2004 Stock Plan. Effective June 2004, we

granted restricted stock units and stock options, as contemplated by the approved plan. We granted the stock options to our

CEO to replace stock options that News Corporation, his former employer, cancelled. During the year ended December 31,

2004, we recognized $57.1 million of stock-based compensation expense, which includes the cost related to restricted stock

units, the cost of replacement options granted to our CEO, and the cost associated with former employees of News Corporation

who became our employees and retained their News Corporation stock options.

During December 2003, upon completion of the News Corporation transactions, we expensed related costs of about $132

million that primarily included investment advisor fees of about $49 million, retention benefits of about $65 million and

severance benefits of about $15 million to “General and administrative expenses” in the Consolidated Statements of Operations.

For us, the News Corporation transactions represented an exchange of equity interests by investors. As such, we continued to

account for our assets and liabilities at historical cost and did not apply purchase accounting. We recorded the $275.0 million

special cash dividend payment to GM as a reduction to additional paid-in capital. We also recorded a $25.1 million decrease to

additional paid-in capital representing the difference between our consolidated tax receivable from GM as determined on a

separate return basis and the receivable determined pursuant to the amended income tax allocation agreement between GM and

us. See Note 10 of the Notes to the Consolidated Financial Statements in Item 8, Part II for additional information regarding the

amended income tax allocation agreement.

During the first quarter of 2003, we and America Online, Inc., or AOL, agreed to terminate a strategic alliance, which the

companies had entered into in June 1999. In connection with the termination of the alliance, we recorded a charge of $23.0

million in the fourth quarter of 2002 to “General and administrative expenses” in the Consolidated Statements of Operations

and AOL released us from our commitment to spend up to approximately $1 billion in additional sales, marketing, development

and promotion efforts in support of certain specified products and services.

31