DIRECTV 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

vesting period. We elected to follow the prospective method of adoption, which resulted in the recognition of fair value based

compensation cost in the Consolidated Statements of Operations for stock options and other stock-based awards granted to

employees or modified on or after January 1, 2003. We accounted for stock options, restricted stock units and other stock-based

awards granted prior to January 1, 2003 under the intrinsic value method of Accounting Principles Board, or APB, Opinion No.

25, “Accounting for Stock Issued to Employees.”

As a result of the completion of the News Corporation transactions on December 22, 2003, all outstanding GM Class H

common stock based awards converted to awards based on our common stock. Under SFAS No. 123, we considered the

conversion a modification of all outstanding awards, and accordingly, have accounted for all awards under the fair value based

method subsequent to the completion of the News Corporation transactions.

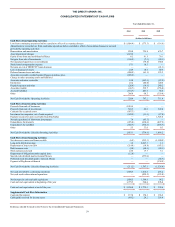

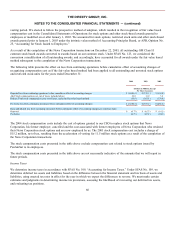

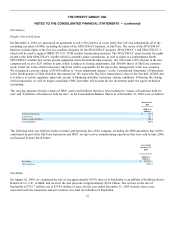

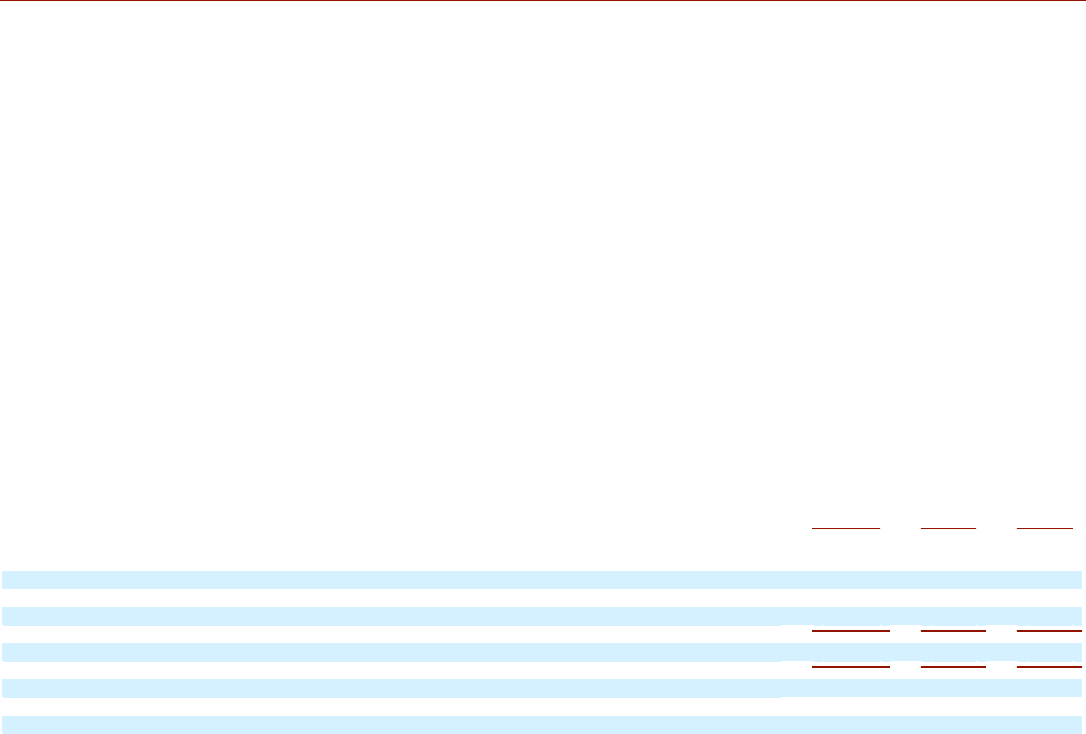

The following table presents the effect on loss from continuing operations before cumulative effect of accounting changes of

recognizing compensation cost as if the fair value based method had been applied to all outstanding and unvested stock options

and restricted stock units for the years ended December 31:

2004

2003

2002

(Dollars in Millions, Except

Per Share Amounts)

Reported loss from continuing operations before cumulative effect of accounting changes

$

(1,056.4

)

$

(375.3

)

$

(114.9

)

Add: Stock compensation cost, net of taxes, included above

36.8

11.9

3.2

Deduct: Total stock compensation cost, net of taxes, under the fair value based method

(36.8

)

(107.8

)

(174.9

)

Pro forma loss from continuing operations before cumulative effect of accounting changes

$

(1,056.4

)

$

(471.2

)

$

(286.6

)

Basic and diluted loss from continuing operations before cumulative effect of accounting changes per common share:

Reported

$

(0.77

)

$

(0.27

)

$

(0.12

)

Pro forma

(0.77

)

(0.34

)

(0.21

)

The 2004 stock compensation costs include the cost of options granted to our CEO to replace stock options that News

Corporation, his former employer, cancelled and the cost associated with former employees of News Corporation who retained

their News Corporation stock options and are now employed by us. The 2003 stock compensation cost includes a charge of

$15.2 million, net of tax, resulting from the acceleration of vesting for 11.5 million stock options as a result of the completion of

the News Corporation transactions.

The stock compensation costs presented in the table above exclude compensation cost related to stock options issued by

PanAmSat to its employees.

The stock compensation costs presented in the table above are not necessarily indicative of the amounts that we will report in

future periods.

Income Taxes

We determine income taxes in accordance with SFAS No. 109, “Accounting for Income Taxes.” Under SFAS No. 109, we

determine deferred tax assets and liabilities based on the difference between the financial statement and tax basis of assets and

liabilities, using enacted tax rates in effect for the year in which we expect the differences to reverse. We must make certain

estimates and judgments in determining income tax provisions, assessing the likelihood of recovering our deferred tax assets,

and evaluating tax positions.

66