DIRECTV 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

We are a publicly-traded company with our common stock listed as “DTV” on the NYSE. As part of the News Corporation

transactions completed on December 22, 2003, our certificate of incorporation was amended to provide for the following capital

stock: common stock, par value $0.01 per share, 3,000,000,000 shares authorized; Class B common stock, par value $0.01 per

share, 275,000,000 shares authorized; excess stock, par value $0.01 per share, 800,000,000 shares authorized; and preferred

stock, par value $0.01 per share, 9,000,000 shares authorized. As of December 31, 2004, there were no outstanding shares of the

Class B common stock, excess stock or preferred stock.

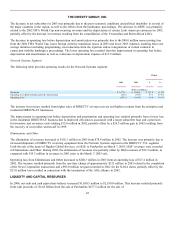

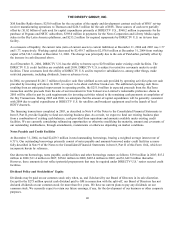

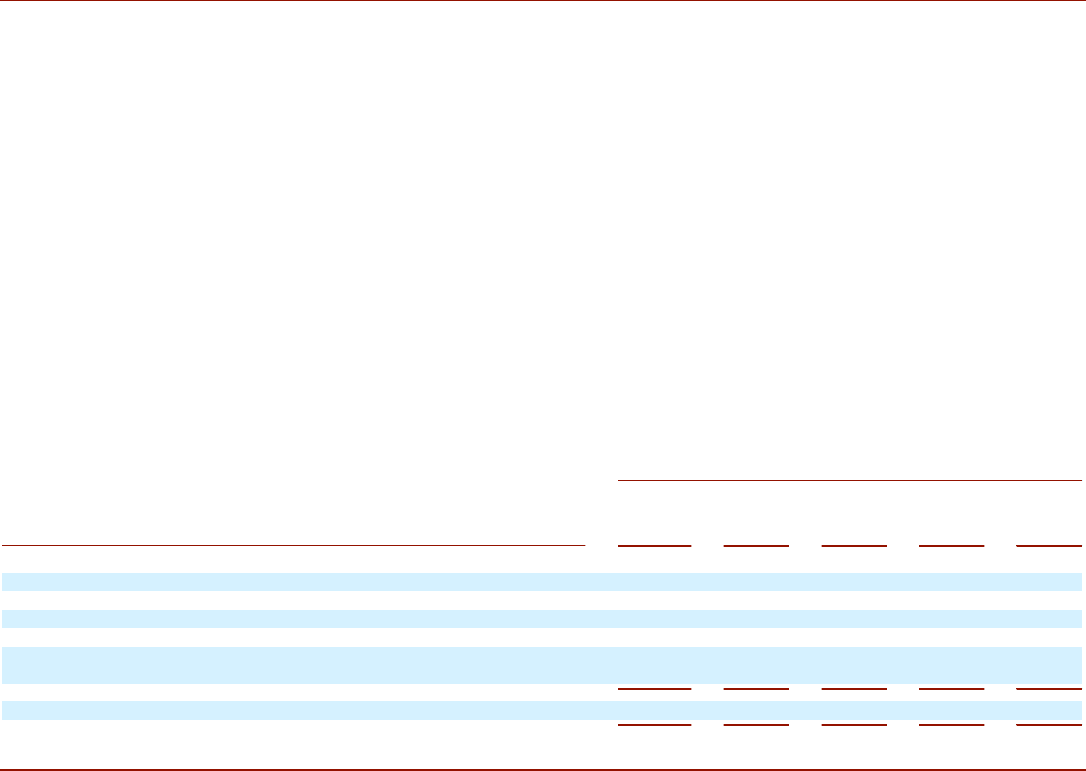

CONTRACTUAL OBLIGATIONS, OFF-BALANCE SHEET ARRANGEMENTS AND CONTINGENCIES

Contractual Obligations

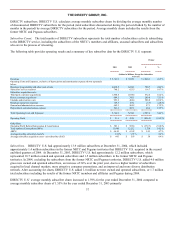

The following table sets forth our contractual obligations as of December 31, 2004, including the future periods in which

payments are expected. Additional details regarding these obligations are provided in the Notes to the Consolidated Financial

Statements in Item 8 referenced in the table.

Payments Due By Period

Contractual Obligations

Total

Less than

1 year

1-3 years

3-5 years

More than

5 years

(Dollars in Millions)

Long-Term Debt Obligations (Note 9)(a)

$

3,582.0

$

174.1

$

350.6

$

1,036.2

$

2,021.1

Purchase Obligations (Note 21)(b)

7,034.8

1,230.7

2,200.8

2,294.8

1,308.5

Operating Lease Obligations (Note 21)(c)

663.5

89.3

172.6

144.5

257.1

Capital Lease Obligations

107.7

27.4

62.8

17.5

—

Other Long-Term Liabilities Reflected on the Consolidated Balance Sheets under GAAP

(Note 11)(d)

504.8

80.3

138.3

155.7

130.5

Total

$

11,892.8

$

1,601.8

$

2,925.1

$

3,648.7

$

3,717.2

(a)

Long-term debt obligations include interest calculated based on the rates in effect at December 31, 2004, however the

obligations for the years one through five do not reflect potential prepayments that may be required under DIRECTV U.S.’

senior secured credit facilities after 2004.

(b)

Purchase obligations consist of broadcast programming commitments, satellite construction contracts, service contract

commitments and remaining payments related to the Sky Transactions. Broadcast programming commitments include

guaranteed minimum contractual commitments that are typically based on a minimum number of required subscribers

subscribing to the related programming. Actual payments may exceed the minimum payment requirements if the actual

number of subscribers subscribing to the related programming exceeds the minimum amounts. Satellite construction

contracts typically exclude the cost to insure and launch satellites into orbit, which costs can be significant to the overall

cost of placing a satellite into service. Service contract commitments include minimum commitments for the purchase of

services that have been outsourced to third parties, such as customer call center operations, billing services and telemetry,

tracking and control services. In most cases, actual payments, which are typically based on volume, usually exceed these

minimum amounts. We exclude from the minimum payments above DIRECTV U.S.’ remaining commitment to purchase

in excess of $500.0 million of set-top receivers from Thomson during the first three years of the Contract Term based on

current set-top receiver prices.

(c)

Certain of the operating leases contain escalation clauses and renewal or purchase options, which we do not consider in the

amounts disclosed.

(d)

Other long-term liabilities include amounts DIRECTV U.S. owes to the NRTC for the purchase of distribution rights and

to the NRTC members that elected the long-term payment option resulting from the

47