DIRECTV 2004 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

Note 18. DLA LLC Reorganization

On March 18, 2003, DLA LLC filed a voluntary petition for reorganization under Chapter 11 of the U.S. Bankruptcy Code in

the U.S. Bankruptcy Court for the District of Delaware, or Bankruptcy Court. On February 13, 2004, the Bankruptcy Court

confirmed DLA LLC’s Plan of Reorganization, or the Reorganization Plan, which became effective on February 24, 2004.

Also, effective February 24, 2004, we made a contribution of certain claims, loans, equity and other interests in LOCs selling

the DIRECTV service in Latin America, and converted certain debt into equity, which increased our equity interest in the

restructured DLA LLC from 74.7% to approximately 85.9%. Darlene, which also contributed its equity and other interests in

various LOCs, holds the remaining approximately 14.1% equity interest in the restructured DLA LLC. The restructuring in

bankruptcy and the contributions by us and Darlene provided DLA LLC with direct control of the most significant LOCs and

assets. The net result of these transactions was an increase in minority interests of $47.3 million.

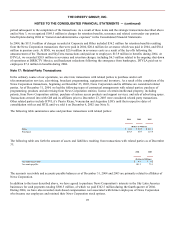

As of December 31, 2003, DLA LLC had approximately $784.8 million in assets, consisting principally of accounts receivable

of $728.7 million principally from LOCs, net fixed assets of $40.4 million and cash of $4.4 million. Liabilities subject to

compromise are DLA LLC’s unsecured liabilities incurred prior to the filing for reorganization under Chapter 11 of the

Bankruptcy Code. As of December 31, 2003, DLA LLC liabilities subject to compromise totaled $1.6 billion, which includes

$1.4 billion of unsecured debt obligations owed to the Company.

Our Consolidated Balance Sheet as of December 31, 2003 includes liabilities subject to compromise of DLA LLC of

approximately $206.7 million.

Reorganization income was $43.0 million in 2004 compared to reorganization expense of $212.3 million in 2003. The

reorganization income in 2004 includes a $62.6 million gain as a result of the settlement of certain obligations in connection

with the confirmation of the Reorganization Plan, partially offset by costs incurred to file the bankruptcy petition, legal and

consulting costs and other charges related to the DLA LLC reorganization. Reorganization expense of $212.3 million in 2003

includes the costs incurred to file the bankruptcy petition, ongoing related legal and consulting costs, costs related to settlement

agreements reached with creditors, the write-off of intangible assets and other charges related to the reorganization. Also

included in reorganization expense are accruals for any claims allowed in the Chapter 11 proceeding for amounts not previously

recognized as liabilities subject to compromise.

The DLA LLC Second Amended and Restated Limited Liability Company Agreement, as amended in February 2004, or the

DLA LLC Agreement, provides Darlene the right, under certain circumstances, to require us to purchase all of Darlene’s equity

interests in DLA LLC for $200.0 million (plus the amount of any outstanding debt of DLA LLC owed to Darlene). The DLA

LLC Agreement also provides that we have the right, under certain circumstances, to require Darlene to sell all of its equity

interests in DLA LLC to us for $400.0 million (plus the amount of any outstanding debt of DLA LLC owed to Darlene). Such

events are triggered if certain conditions are satisfied, including there is a combination of the business or operations of DLA

LLC with substantially all of the DTH satellite business or operations of Sky Latin America, an affiliate of News Corporation,

or other events as described in the DLA LLC Agreement, or a Sky Deal. We do not believe the conditions necessary to trigger

these events have been satisfied. In addition, under the terms of the DLA LLC Agreement, from February 24, 2005 through

February 24, 2010, either we or Darlene may provide notice to the other that the notifying party wishes to attempt a sale of DLA

LLC or an initial public offering of the equity of DLA LLC. The delivery of such notices starts a process which, among other

things, may trigger certain call rights by the non-notifying party. If such a notice were delivered by Darlene within the period

provided, and

96