DIRECTV 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

agreement to certain rural territories in the United States and all related agreements. As consideration, DIRECTV U.S. agreed to

pay the NRTC approximately $4.4 million per month through June 2011, or $322.1 million on a present value basis, calculated

using an estimated incremental annual borrowing rate of 4.3%. As a result of this agreement, DIRECTV U.S. now has the right

to sell its services in all territories across the United States. The present value of the cash payments to be made to the NRTC

plus fees paid associated with the transaction, the total of which amounted to $334.1 million, were recorded in “Accrued

liabilities and other” and “Other Liabilities and Deferred Credits,” with a corresponding amount recorded as distribution rights

in “Intangible Assets, net” in the Consolidated Balance Sheets. The distribution rights intangible asset is being amortized to

expense over seven years, which represents the remaining life of the DIRECTV service distribution agreement.

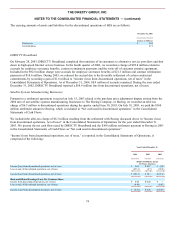

NRTC Member Subscribers

In connection with the NRTC transaction described above, during the second and third quarters of 2004, all NRTC members,

excluding Pegasus Satellite Television, Inc., or Pegasus, elected to sell their subscribers to DIRECTV U.S. DIRECTV U.S. paid

$187.2 million in the third quarter of 2004 for members electing a lump-sum payout plus additional fees associated with the

transaction and recorded $198.3 million in “Accrued liabilities and other” and “Other Liabilities and Deferred Credits” for those

members electing the long-term payment option of seven years plus interest. As a result, DIRECTV U.S. recorded a subscriber

related intangible asset in “Intangible Assets, net” in the Consolidated Balance Sheets amounting to $385.5 million, which is

being amortized over the estimated subscriber lives of approximately six years.

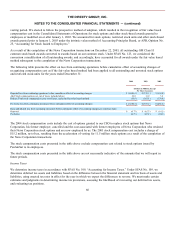

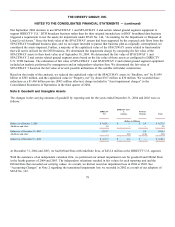

The total obligations owed to the NRTC and its members electing the long-term payment option amounted to $487.8 at

December 31, 2004 and is payable approximately as follows: $63.3 million in 2005, $67.1 million in 2006, $71.2 million in

2007, $75.5 million in 2008, $80.2 million in 2009 and $130.5 million thereafter.

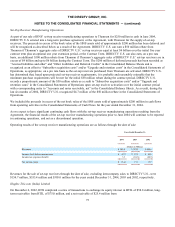

Pegasus Subscribers

On August 27, 2004, DIRECTV U.S. acquired the subscribers and certain assets, consisting primarily of subscriber accounts

receivable, of Pegasus for a total purchase price of $987.9 million. The total cash consideration DIRECTV U.S. paid to Pegasus

amounted to $773.0 million, which is the total purchase price net of amounts owed by Pegasus for programming and other

services, and a May 2004 $63 million judgment in favor of DIRECTV U.S. As a result of the transaction, DIRECTV U.S.

recorded a subscriber related intangible asset in “Intangible Assets, net” in the Consolidated Balance Sheets amounting to

$951.3 million, which is being amortized over the estimated subscriber lives of approximately five years.

Other

As part of an arrangement with Telesat, DIRECTV U.S. agreed to provide Telesat the use of the DIRECTV 3 satellite, which

was previously used as an in-orbit spare, through the end of its useful life and in return Telesat agreed to allow DIRECTV U.S.

the use of its 72.5 WL orbital location through 2008. As additional consideration for DIRECTV U.S.’ use of 72.5 WL,

DIRECTV U.S. also agreed to allow Telesat to use DIRECTV 5 or a similar satellite for a five year period, subject to certain

conditions, beginning at the end of 2008. Upon receipt of final approval from the FCC in the third quarter of 2004, DIRECTV

U.S. transferred DIRECTV 3 to Telesat and relocated DIRECTV 5, which was also an in-orbit spare, to 72.5 WL to provide

additional local channels and other programming in the United States. These transactions have been recorded as an exchange of

similar productive assets based on the net book values of the assets exchanged. As a result, we recorded a $162.6 million 72.5

WL orbital license intangible asset, which is equal to the $71.5 million net book value of the DIRECTV 3 satellite transferred

from satellites, net, and an accrual for deferred lease revenues of $91.1 million, representing the value of the transferred satellite

over the five year lease period. The 72.5 WL orbital license intangible asset is being amortized over the four year contract

period, and the deferred lease revenues will be recognized as an offset to depreciation expense during the five year lease period

beginning at the end of 2008.

71