Burger King 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

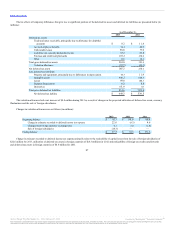

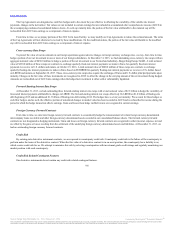

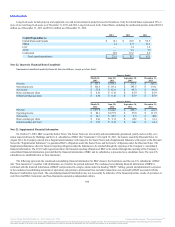

The following tables present the required quantitative disclosures for our derivative instruments (in millions):

Interest rate caps $ — $ (17.1) $ (67.2)

Forward-starting interest rate swaps $ 169.1 $ 0.7 $ —

Cross-currency rate swaps $ (14.8) $ (10.8) $ —

Interest rate caps—gain (loss) reclassified into interest expense, net (1) $ (6.1) $ (3.2) $ 0.5

Interest rate caps—gain (loss) reclassified into other operating expenses (income),

net $ — $ (8.4) $ —

Foreign currency forward contracts—gain (loss) recognized in other operating

expenses (income), net $ (0.4) $ (0.5) $ 0.1

Interest Rate Swaps—gain (loss) recognized in interest expense, net $ — $ — $ (0.1)

(1) Includes $1.1 million in gains during 2011 related to the interest rate caps modified in connection with the 2011 Amended Credit Agreement.

The net amount of pre-tax gains and losses in accumulated other comprehensive income (loss) as of December 31, 2013 that we expect to be reclassified

into earnings within the next 12 months is $9.3 million of losses.

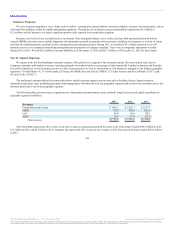

Cash dividend payments to shareholders of common stock were $84.3 million in 2013, $14.0 million in 2012 and $393.4 million in 2011.

Although we do not currently have a dividend policy, we may declare dividends periodically if our Board of Directors determines that it is in the best

interests of the shareholders. The terms of the 2012 Credit Agreement, Senior Notes Indenture and Discount Notes Indenture limit our ability to pay cash

dividends in certain circumstances. In addition, because we are a holding company, our ability to pay cash dividends on shares (including fractional shares)

of our common stock may be limited by restrictions on our ability to obtain sufficient funds through dividends from our subsidiaries, including the

restrictions under the 2012 Credit Agreement, Senior Notes Indenture and Discount Notes Indenture. Subject to the foregoing, the payment of cash dividends

in the future, if any, will be at the discretion of our Board of Directors and will depend upon such factors as earnings levels, capital requirements, our overall

financial condition and any other factors deemed relevant by our Board of Directors.

97

Source: Burger King Worldwide, Inc., 10-K, February 21, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.