Burger King 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Franchise agreements are not assignable without our consent, and we generally have a right of first refusal if a franchisee proposes to sell a restaurant.

Defaults (including non-payment of royalties or advertising contributions, or failure to operate in compliance with our standards) can lead to termination of the

franchise agreement. Prospective franchisees must meet our minimum approval criteria to ensure that they are adequately capitalized and that they satisfy

certain other requirements.

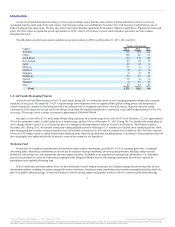

U.S. and Canada. In the U.S. and Canada, we (or our master franchisee with respect to sub-franchise restaurants in Canada) typically enter into a

separate franchise agreement for each restaurant. The typical franchise agreement in the U.S. and Canada has a 20-year term (for both initial grants and

renewals of franchises) and contemplates a one-time franchise fee which must be paid in full before the restaurant opens for business, or in the case of

renewal, before expiration of the current franchise term. Subject to the incentive programs described below, most new franchise restaurants pay a royalty of

4.5% in the U.S. In Canada, our master franchisee typically pays a royalty of 3.0% to BKC and royalties paid in connection with sub-franchise restaurants

are shared between BKC and the master franchisee. The weighted average royalty rate in the U.S. and Canada was 3.9% as of December 31, 2013. In addition

to their royalties, franchisees in the U.S. and Canada are generally required to make a contribution to the advertising fund equal to a percentage of gross sales,

typically 4%, on a monthly basis.

During 2013, we offered franchisees reduced up-front franchise fees and limited-term royalty rate reductions to accelerate development of new

restaurants. This development incentive program will remain in place through the end of 2014. In October 2013, we launched a new program to encourage

franchisees with low performing restaurants to close these restaurants and open replacement restaurants by offering limited-term credits for BKC charges

associated with the replacement restaurants. In addition, in an effort to improve the image of our restaurants in the United States, we offered U.S. franchisees

reduced up-front franchise fees and limited-term royalty and advertising fund rate reductions to remodel restaurants in our 20/20 image during 2012 and 2013.

These limited-term incentive programs are expected to negatively impact our effective royalty rate until 2021. However, we expect this impact to be partially

mitigated as we will also be entering into new franchise agreements in the United States with a 4.5% royalty rate.

International. Historically, in our international markets, we entered into franchise agreements for each restaurant with up-front franchise fees and

monthly royalties and advertising contributions each of up to 5% of gross sales. However, as part of our international growth strategy, we have increasingly

entered into master franchise agreements or development agreements that grant franchisees exclusive development rights and, in some cases, require them to

provide support services to other franchisees in their markets. We enter into these agreements with well capitalized partners who are willing to make substantial

upfront equity commitments, agree to aggressive development targets, and have strong local management teams. The up-front franchise fees and royalty rate

paid by master franchisees vary from country to country, depending on the facts and circumstances of each market.

In some countries, we have entered into master franchise agreements that allow franchisees to sub-franchise restaurants to other franchisees within their

territory. In other countries, we have entered into arrangements with franchisees under which they have agreed to nominate third party franchisees to develop

and operate restaurants within their respective territories under franchise agreements with us. As part of these arrangements, the franchisees have agreed to

provide certain support services to franchisees on our behalf, and, in some cases, we have agreed to share royalties and franchise fees paid by such third

party franchisees. As part of our international growth strategy, we are also entering into joint ventures with franchisees and granting master franchise and

development rights to these entities. As part of these arrangements, we seek to receive a meaningful minority equity stake in the joint venture. We expect to

continue to use this investment vehicle as one of the strategies to increase our presence globally.

Franchise Restaurant Leases. We have not historically required that we own the land or the building associated with our franchise restaurants and our

standard franchise agreement does not contain a lease component. However, in implementing our refranchising initiative, we have, in many circumstances,

retained the lease or title on the property and building associated with the refranchised restaurants. Consequently, the number of our property leases with

franchisees increased significantly during 2012. To the extent that we lease or sublease the property to a franchisee, we will enter into a separate lease

agreement. For properties that we lease from third-party landlords and sublease to franchisees, our leases generally provide for fixed rental payments and may

provide for contingent rental payments based on a restaurant’s annual gross sales. Franchisees who lease land only or land and building from us do so on a

“triple net” basis. Under these triple net leases, the franchisee is obligated to pay all costs and expenses, including all real property taxes and assessments,

repairs and maintenance and insurance. As of December 31, 2013, we leased or subleased to franchisees 1,845 properties in the U.S. and Canada, 113

properties in EMEA, primarily sites located in the U.K. and Germany, and six properties in LAC, all located in Mexico. These properties represented

approximately 25% in the U.S. and Canada and 3% in EMEA of our total franchise restaurant count in such regions. As of December 31, 2013, we did not

lease or sublease any properties to franchisees in APAC.

9

Source: Burger King Worldwide, Inc., 10-K, February 21, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.