Burger King 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

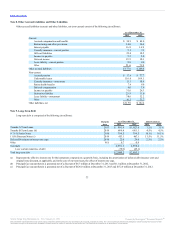

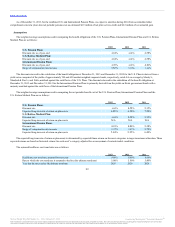

The tax effects of temporary differences that give rise to significant portions of the deferred tax assets and deferred tax liabilities are presented below (in

millions):

Deferred tax assets:

Trade and notes receivable, principally due to allowance for doubtful

accounts $ 9.2 $ 11.6

Accrued employee benefits 34.1 40.5

Unfavorable leases 58.8 77.0

Liabilities not currently deductible for tax 53.2 53.8

Tax loss and credit carryforwards 107.2 130.2

Other 0.5 10.3

Total gross deferred tax assets 263.0 323.4

Valuation allowance (97.7) (93.3)

Net deferred tax assets 165.3 230.1

Less deferred tax liabilities:

Property and equipment, principally due to differences in depreciation 10.3 11.9

Intangible assets 640.2 644.3

Leases 89.0 104.3

Statutory Impairment 9.2 8.8

Derivatives 65.9 0.3

Total gross deferred tax liabilities 814.6 769.6

Net deferred tax liability $ 649.3 $539.5

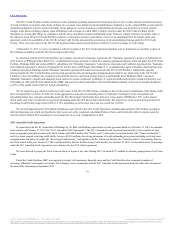

The valuation allowance had a net increase of $4.4 million during 2013 as a result of changes in the projected utilization of deferred tax assets, currency

fluctuations and the sale of foreign subsidiaries.

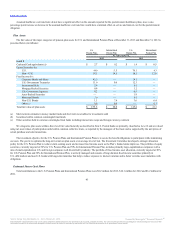

Changes in valuation allowance are as follows (in millions):

Beginning balance $ 93.3 $ 99.6 $ 96.0

Change in estimates recorded to deferred income tax expense 22.6 (8.3) 4.6

Changes from foreign currency exchange rates 0.1 2.0 (1.0)

Sale of foreign subsidiaries (18.3) — —

Ending balance $97.7 $93.3 $99.6

Change in estimates recorded to deferred income tax expense primarily relate to the realizability of capital losses from the sale of foreign subsidiaries of

$22.6 million for 2013, utilization of deferred tax assets in foreign countries of $(8.3) million for 2012 and realizability of foreign tax credit carryforwards

and deferred tax assets in foreign countries of $4.6 million for 2011.

87

Source: Burger King Worldwide, Inc., 10-K, February 21, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.