Burger King 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

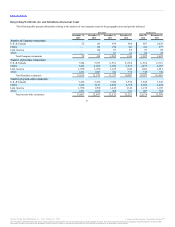

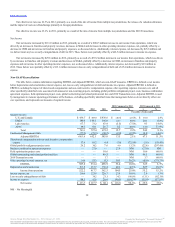

(In millions)

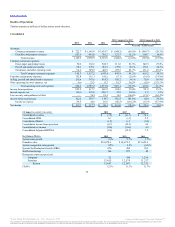

Cash and cash equivalents $ 786.9 $ 546.7 $ 459.0 $ 207.0 $ 187.6 $ 121.7

Total assets (2) 5,828.5 5,564.0 5,608.4 5,686.2 2,747.2 2,707.1

Total debt and capital lease obligations (2) 3,037.0 3,049.3 3,139.2 2,792.1 826.3 888.9

Total liabilities (2) 4,312.3 4,389.0 4,559.2 4,239.0 1,618.8 1,732.3

Total stockholders’ equity (2) 1,516.2 1,175.0 1,049.2 1,447.2 1,128.4 974.8

System-wide sales growth (3)(4) 4.2% 5.7% 1.7% 2.2% 2.1% 4.2%

Comparable sales growth (3)(4)(5) 0.5% 3.2% (0.5)% (2.7)% (2.3)% 1.2%

Franchise Sales (in millions) (4) $16,078.3 $14,672.5 $13,653.4 $ 6,721.2 $13,055.3 $12,788.7

Company Restaurant Margin Percentage (6) 12.3% 11.3% 11.7% 12.9% 12.2% 12.6%

(1) Amount includes $26.2 million of global portfolio realignment project costs for 2013. Amount includes $30.2 million of global portfolio realignment

project costs and $27.0 million of business combination agreement expenses for 2012. Amount includes $3.7 million of 2010 Transaction costs, $46.5

million of global restructuring and related professional fees, $10.6 million of field optimization project costs and $7.6 million of global portfolio

realignment project costs for 2011. Amount includes $94.9 million of 2010 Transaction costs and $67.2 million of global restructuring and related

professional fees for October 19, 2010 to December 31, 2010.

(2) Amounts in the successor periods reflect the application of acquisition accounting as a result of the 3G Acquisition.

(3) Comparable sales growth and system-wide sales growth are analyzed on a constant currency basis, which means they are calculated by translating prior

year results at current year average exchange rates, to remove the effects of currency fluctuations from these trend analyses. We believe these constant

currency measures provide a more meaningful analysis of our business by identifying the underlying business trends, without distortion from the effect

of foreign currency movements.

(4) Unless otherwise stated, comparable sales growth and system-wide sales growth are presented on a system-wide basis, which means they include

Company restaurants and franchise restaurants. Franchise sales represent sales at all franchise restaurants and are revenues to our franchisees. We do

not record franchise sales as revenues; however, our royalty revenues are calculated based on a percentage of franchise sales. See “ Management’s

Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics ” in Part II, Item 7 of this report.

(5) Comparable sales growth refers to the change in restaurant sales in one period from the same prior year period for restaurants that have been opened for

thirteen months or longer.

(6) Company restaurant margin is derived by subtracting Company restaurant expenses from Company restaurant revenues, which we analyze as a

percentage of Company restaurant revenues, a metric we refer to as Company Restaurant Margin Percentage.

30

Source: Burger King Worldwide, Inc., 10-K, February 21, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.