Burger King 2013 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2013 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

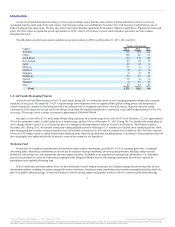

As of December 31, 2013, our restaurants were operated, directly by us or by franchisees, in 97 countries and U.S. territories worldwide (including

Guam and Puerto Rico, which are considered part of our international business). During 2013, our revenues from international operations represented 47% of

total revenues and we intend to continue expansion of our international operations. As a result, our business is increasingly exposed to risks inherent in foreign

operations. These risks, which can vary substantially by market, are described in many of the risk factors discussed in the section and include the following:

• governmental laws, regulations and policies adopted to manage national economic conditions, such as increases in taxes, austerity measures that

impact consumer spending, monetary policies that may impact inflation rates and currency fluctuations;

• the risk of single franchisee markets and single distributor markets;

• the risk of markets in which we have granted exclusive development and subfranchising rights;

• the effects of legal and regulatory changes and the burdens and costs of our compliance with a variety of foreign laws;

• changes in the laws and policies that govern foreign investment and trade in the countries in which we operate;

• risks and costs associated with political and economic instability, corruption, anti-American sentiment and social and ethnic unrest in the

countries in which we operate;

• the risks of operating in developing or emerging markets in which there are significant uncertainties regarding the interpretation, application and

enforceability of laws and regulations and the enforceability of contract rights and intellectual property rights;

• risks arising from the significant and rapid fluctuations in currency exchange markets and the decisions and positions that we take to hedge such

volatility;

• changing labor conditions and difficulties in staffing the international operations of our franchisees;

• the impact of labor costs on our franchisees’ margins given our labor-intensive business model and the long-term trend toward higher wages in

both mature and developing markets and the potential impact of union organizing efforts on day-to-day operations of our restaurants; and

• the effects of increases in the taxes we pay and other changes in applicable tax laws.

These factors may increase in importance as we expect our franchisees to open new restaurants in international markets as part of our growth strategy.

Our international operations are impacted by fluctuations in currency exchange rates and changes in currency regulations. Our royalty payments in our

European markets and in certain other countries are denominated in currencies other than U.S. dollars. Consequently, our franchise revenues from those

countries are subject to fluctuations in currency exchange rates. Furthermore, our franchise royalties from our international franchisees are calculated based on

local currency sales; consequently our franchise revenues are still impacted by fluctuations in currency exchange rates. Our revenues and expenses are

translated using the average rates during the period in which they are recognized and are impacted by changes in currency exchange rates.

Fluctuations in interest rates may also affect our business. We attempt to minimize this risk and lower our overall borrowing costs through the utilization

of derivative financial instruments, primarily interest rate caps. These instruments are entered into with financial institutions and have reset dates and critical

terms that match those of our forecasted interest payments. Accordingly, any changes in interest rates we pay are partially offset by changes in the market

value associated with derivative financial instruments. We do not attempt to hedge all of our debt and, as a result, may incur higher interest costs for portions

of our debt which are not hedged. In addition, we enter into forward contracts to reduce our exposure to volatility from foreign currency fluctuations associated

with certain foreign currency-denominated assets. However, for a variety of reasons, we do not hedge our revenue exposure in other currencies. Therefore, we

are exposed to volatility in those other currencies, and this volatility may differ from period to period. As a result, the foreign currency impact on our operating

results for one period may not be indicative of future results.

17

Source: Burger King Worldwide, Inc., 10-K, February 21, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.