Burger King 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

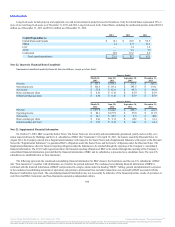

Long-lived assets include property and equipment, net, and net investment in property leased to franchisees. Only the United States represented 10% or

more of our total long-lived assets as of December 31, 2013 and 2012. Long-lived assets in the United States, including the unallocated portion, totaled $885.4

million as of December 31, 2013 and $921.6 million as of December 31, 2012.

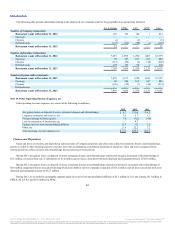

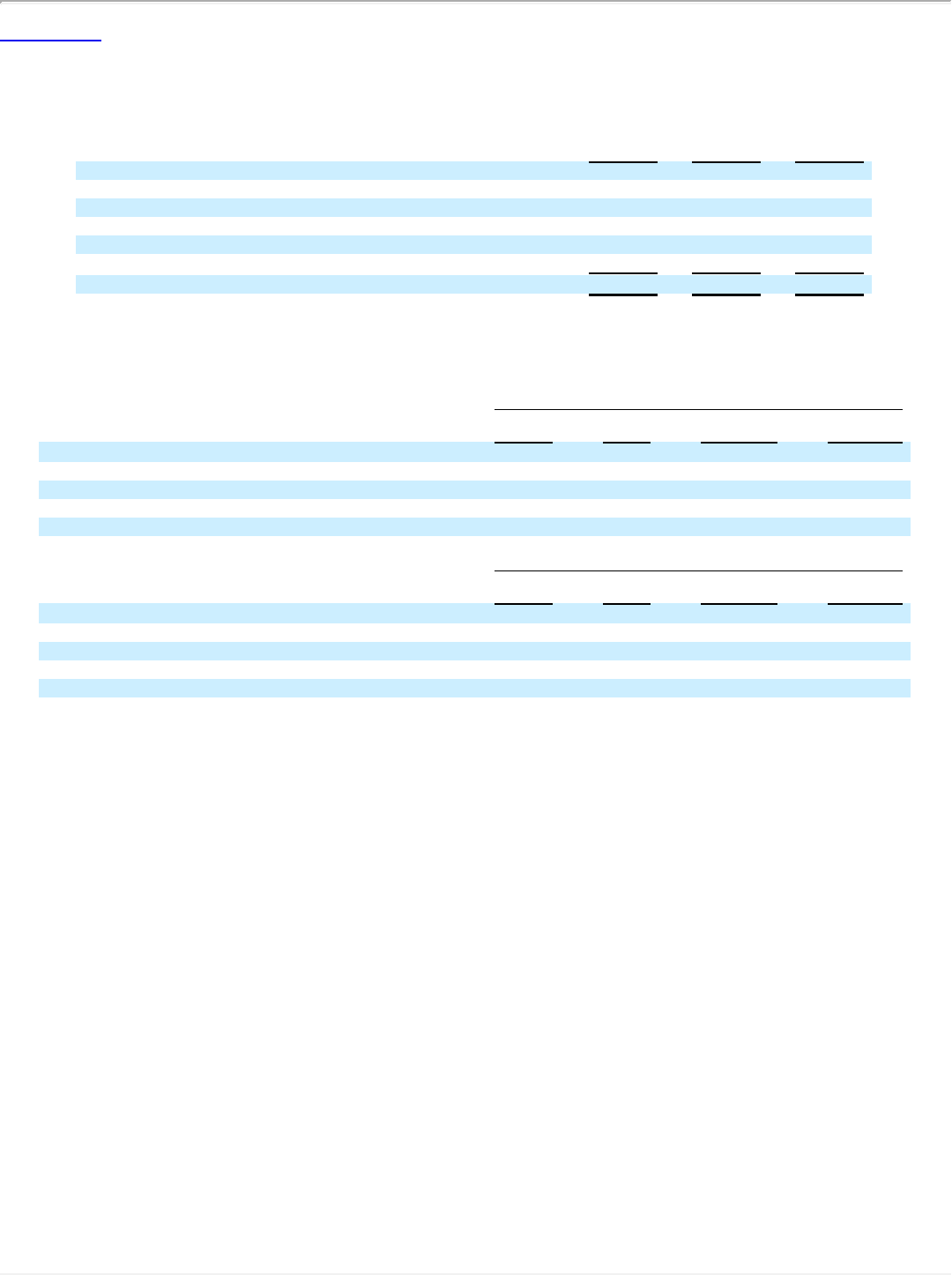

United States and Canada $ 10.3 $ 41.9 $ 56.5

EMEA 2.4 6.9 11.1

LAC — 1.4 1.8

APAC — 0.8 3.8

Unallocated 12.8 19.2 8.9

Total capital expenditures $25.5 $70.2 $ 82.1

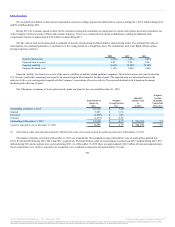

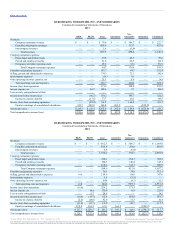

Summarized unaudited quarterly financial data (in millions, except per share data):

Revenue $ 327.7 $ 278.3 $ 275.1 $ 265.2

Operating income $ 102.4 $ 133.2 $ 145.5 $ 141.1

Net income $ 35.8 $ 62.9 $ 68.2 $ 66.8

Basic earnings per share $ 0.10 $ 0.18 $ 0.19 $ 0.19

Diluted earnings per share $ 0.10 $ 0.18 $ 0.19 $ 0.19

Revenue $ 569.9 $ 540.8 $ 455.7 $ 404.5

Operating income $ 84.1 $ 127.9 $ 93.8 $ 111.9

Net income $ 14.3 $ 48.2 $ 6.6 $ 48.6

Basic earnings per share $ 0.04 $ 0.14 $ 0.02 $ 0.14

Diluted earnings per share $ 0.04 $ 0.14 $ 0.02 $ 0.14

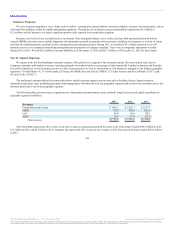

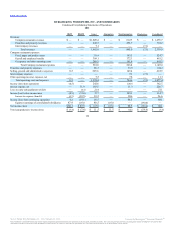

On October 19, 2010, BKC issued the Senior Notes. The Senior Notes are irrevocably and unconditionally guaranteed, jointly and severally, on a

senior unsecured basis by Holdings and the U.S. subsidiaries of BKC (the “Guarantors”). On April 19, 2011, the Issuers issued the Discount Notes. In

August 2012, the Company entered into a Supplemental Indenture with respect to the Senior Notes and a Supplemental Indenture with respect to the Discount

Notes (the “Supplemental Indentures”) to guarantee BKC’s obligations under the Senior Notes and the Issuers’ obligations under the Discount Notes. The

Supplemental Indentures allow the financial reporting obligation under the Indentures to be satisfied through the reporting of the Company’s consolidated

financial information. The 2012 Credit Agreement allows the financial reporting obligation of BKC to be satisfied through the reporting of the Company’s

consolidated financial information, provided that the financial information of BKC and its subsidiaries is presented on a standalone basis. The non-U.S.

subsidiaries are identified below as Non-Guarantors.

The following represents the condensed consolidating financial information for BKC (Issuer), the Guarantors and the non-U.S. subsidiaries of BKC

(the “Non-Guarantors”), together with eliminations, as of and for the periods indicated. The condensed consolidating financial information of BKW is

combined with the financial information of BKCF and presented in a single column under the heading “BKW.” Selling, general and administrative expenses

in the condensed consolidating statements of operations only pertain to professional fees and other transaction costs incurred by BKW associated with the

Business Combination Agreement. The consolidating financial information may not necessarily be indicative of the financial position, results of operations or

cash flows had BKC, Guarantors and Non-Guarantors operated as independent entities.

106

Source: Burger King Worldwide, Inc., 10-K, February 21, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.