Burger King 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

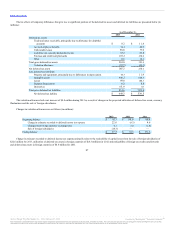

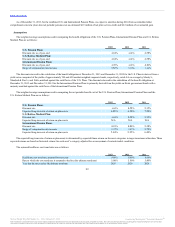

The amount and expiration dates of operating loss and tax credit carryforwards as of December 31, 2013 are as follows (in millions):

Non-U.S. net operating loss carryforwards $ 2.1 2014 - 2023

Non-U.S. net operating loss carryforwards 205.1 Indefinite

State net operating loss carryforwards 63.8 2016 - 2033

U.S. foreign tax credits 15.3 2014 - 2015

Total $ 286.3

During 2013, the company provided for $1.0 million of taxes on $2.7 million of foreign undistributed earnings of certain subsidiaries that are expected

to be repatriated. Deferred tax liabilities have not been provided on approximately $499.0 million of undistributed earnings that are considered to be

permanently reinvested. Determination of the deferred income tax liability on these unremitted earnings is not practicable. Such liability, if any, depends on

circumstances existing if and when remittance occurs.

We had $27.7 million of unrecognized tax benefits at December 31, 2013, which if recognized, would favorably affect the effective income tax rate. A

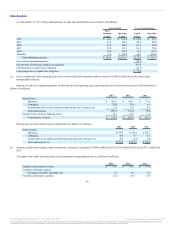

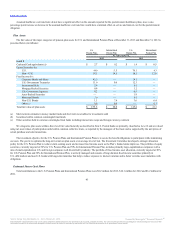

reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows (in millions):

Beginning balance $ 23.3 $ 21.6 $ 22.4

Additions on tax position related to the current year 2.2 1.9 1.4

Additions for tax positions of prior years 2.4 0.9 2.8

Reductions for tax positions of prior year (0.1) (0.5) (2.9)

Reductions for settlement (0.1) (0.5) (2.0)

Reductions due to statute expiration — (0.1) (0.1)

Ending balance $ 27.7 $23.3 $21.6

During the twelve months beginning January 1, 2014, it is reasonably possible we will reduce unrecognized tax benefits by approximately $0.3 million,

primarily as a result of the expiration of certain statutes of limitations and the resolution of audits.

We recognize interest and penalties related to unrecognized tax benefits in income tax expense. The total amount of accrued interest and penalties was $4.1

million at December 31, 2013 and $3.5 million at December 31, 2012. Potential interest and penalties associated with uncertain tax positions recognized was

$0.6 million during the year ended December 31, 2013, $0.3 million during the year ended December 31, 2012, and zero during the year ended December 31,

2011. To the extent interest and penalties are not assessed with respect to uncertain tax positions, amounts accrued will be reduced and reflected as a reduction

of the overall income tax provision.

We file income tax returns, including returns for our subsidiaries, with federal, state, local and foreign jurisdictions. Generally we are subject to routine

examination by taxing authorities in these jurisdictions, including significant international tax jurisdictions, such as the United Kingdom, Germany, Spain,

Switzerland, Singapore, Canada and Mexico. None of the foreign jurisdictions should be individually material. Our federal income tax returns for fiscal 2009,

2010, the period July 1, 2010 through October 18, 2010 and the period October 19, 2010 through December 31, 2010 are currently under audit by the Internal

Revenue Service. In addition, we have various state and foreign income tax returns in the process of examination. From time to time, these audits result in

proposed assessments where the ultimate resolution may result in owing additional taxes. We believe that our tax positions comply with applicable tax law and

that we have adequately provided for these matters.

88

Source: Burger King Worldwide, Inc., 10-K, February 21, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.