Burger King 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

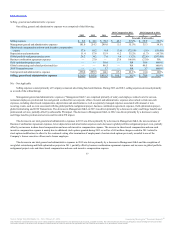

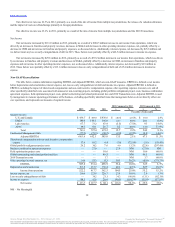

Adjusted EBITDA in 2013 reflects increases in segment income in our EMEA and APAC segments, partially offset by decreases in segment income in

our U.S. and Canada and LAC segments and an increase in Unallocated Management G&A. Unallocated Management G&A represents corporate support

costs in areas such as facilities, finance, human resources, information technology, legal, marketing and supply chain management, which benefit all of our

geographic segments and system-wide restaurants and are not allocated specifically to any of the geographic segments. EBITDA for 2013 increased primarily

for the same reasons that Adjusted EBITDA increased as well as the non-recurrence of Business Combination Agreement expenses, decreases in other operating

(income) expenses, net and decreases in global portfolio realignment project costs, partially offset by an increase in share-based compensation and non-cash

incentive compensation expense.

The increase in Adjusted EBITDA in 2012 was primarily driven by increases in segment income in all of our operating segments and reductions in

Unallocated Management G&A. EBITDA for 2012 increased primarily for the same reasons that consolidated adjusted EBITDA increased as well as the non-

recurrence of global restructuring and related professional fees, field optimization project costs and 2010 Transaction costs, partially offset by Business

Combination Agreement expenses in 2012, increases in global portfolio realignment project costs and increases in other operating (income) expenses, net.

Company:

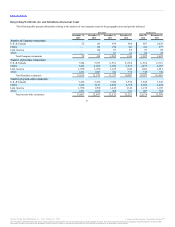

Company restaurant revenues $ 111.2 $792.8 $1,172.0 $ (681.6) $ (379.2)

CRM 13.5 90.1 142.2 (76.6) (52.1)

CRM % 12.1% 11.4% 12.1% 0.8% (0.8)%

Company restaurant expenses as a % of Company restaurant

revenues:

Food and paper 32.6% 33.0% 32.3% 0.4% (0.7)%

Payroll and benefits 29.9% 30.5% 30.4% 0.6% (0.1)%

Depreciation and amortization 5.2% 5.5% 5.7% 0.3% 0.2%

Other occupancy and operating 20.2% 19.6% 19.5% (0.6)% (0.1)%

Franchise:

Franchise and property revenues $ 554.0 $ 472.8 $ 401.3 $ 81.2 $ 71.5

Franchise and property expenses 119.8 82.8 73.0 (37.0) (9.8)

Segment SG&A (1) 52.5 101.9 120.1 49.4 18.2

Segment depreciation and amortization 41.5 68.8 86.2 27.3 17.4

Segment income 436.7 447.0 436.6 (10.3) 10.4

(1) Segment selling, general and administrative expenses (“Segment SG&A”) consists of segment selling expenses and Management G&A.

Favorable/(Unfavorable)

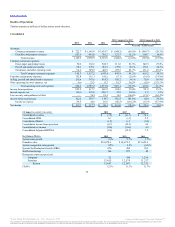

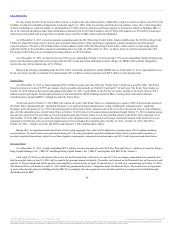

Segment revenues $ (1.3) $ (1.7) $ 6.5

Segment CRM (0.1) (0.2) 0.6

Segment income (0.7) (0.3) 1.0

System-wide sales growth (0.9)% 3.0% (3.3)%

Franchise sales $8,730.4 $8,143.9 $7,510.5

System comparable sales growth (0.9)% 3.5% (3.4)%

System NRG (40) (24) (50)

Net Refranchisings 127 752 38

Restaurant counts at period end

Company 52 183 939

Franchise 7,384 7,293 6,561

System 7,436 7,476 7,500

40

Source: Burger King Worldwide, Inc., 10-K, February 21, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.