Burger King 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

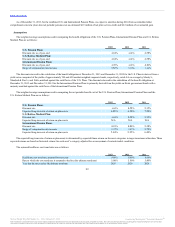

We recorded $14.8 million of share-based compensation expense in selling, general and administrative expenses during 2013, $12.2 million during 2012

and $1.2 million during 2011.

During 2013, the Company agreed to allow for the continued vesting after termination of employment of certain stock options previously awarded to one

of the Company’s former executive officers and a former employee. These were considered stock option modifications, resulting in additional stock

compensation expense of approximately $4.0 million recorded during 2013.

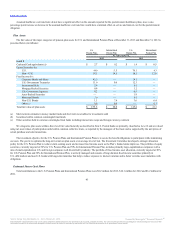

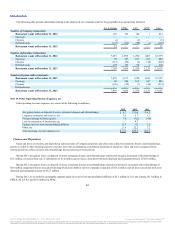

The fair value of each stock option grant is estimated on the date of grant using the Black-Scholes option pricing model. The estimated fair value of

stock options, less estimated forfeitures, is amortized over the vesting period on a straight-line basis. The assumptions used in the Black-Scholes option-

pricing model are as follows:

Risk-free interest rate 1.26% 1.03% 1.93%

Expected term (in years) 6.83 5.50 5.00

Expected volatility 30.00% 35.00% 35.00%

Expected dividend yield 1.10% 0.00% 0.00%

Expected volatility was based on a review of the equity volatilities of publicly-traded guideline companies. The risk-free interest rate was based on the

U.S. Treasury yield with a remaining term equal to the expected option life assumed at the date of grant. The expected term was calculated based on the

analysis of a five-year vesting period coupled with the Company’s expectations of exercise activity. The expected dividend yield is based on the annual

dividend yield at the time of grant.

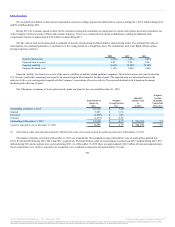

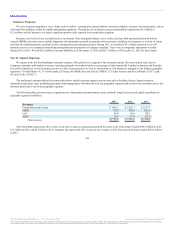

The following is a summary of stock option activity under our plans for the year ended December 31, 2013:

Outstanding at January 1, 2013 16,358 $ 3.69

Granted 3,025 $ 18.30

Exercised (1,570) $ 3.63

Forfeited (1,833) $ 4.66

Outstanding at December 31, 2013 15,980 $6.35 $263,763 7.9

Vested or expected to vest at December 31, 2013 13,583 $6.35 $224,199 7.9

(1) The intrinsic value represents the amount by which the fair value of our stock exceeds the option exercise price at December 31, 2013.

The number of options exercisable at December 31, 2013 was insignificant. The weighted-average estimated fair value of stock options granted was

$5.23, $3.80 and $0.58 during 2013, 2012 and 2011, respectively. The total intrinsic value of stock options exercised was $25.3 million during 2013, $5.7

million during 2012 and no options were exercised during 2011. As of December 31, 2013, there was approximately $26.2 million of total unrecognized share-

based compensation cost, which is expected to be recognized over a weighted-average period of approximately 1.8 years.

100

Source: Burger King Worldwide, Inc., 10-K, February 21, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.