Burger King 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

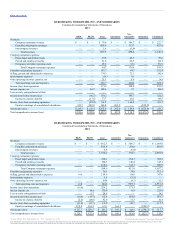

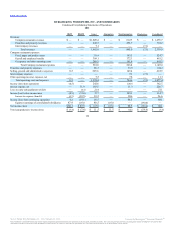

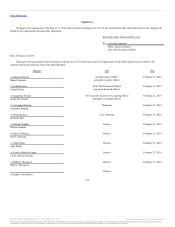

Condensed Consolidating Statements of Cash Flows

Net income $ 88.1 $ 87.9 $ 107.0 $ 107.0 $ 88.5 $ (390.4) $ 88.1

Adjustments to reconcile net income to net cash provided by

(used for) operating activities:

Equity in earnings of consolidated subsidiaries (87.9) (107.0) (88.5) (107.0) — 390.4 —

Depreciation and amortization — — 91.2 — 45.2 — 136.4

(Gain) loss on early extinguishment of debt — (0.3) 21.4 — — — 21.1

Amortization of deferred financing costs and debt

issuance discount — 31.8 14.5 — — — 46.3

Equity in net (income) loss from unconsolidated affiliates — — 1.2 — — — 1.2

(Gain) loss on remeasurement of foreign denominated

transactions — — 0.6 — (0.2) — 0.4

Realized loss on terminated caps/swaps — — 0.5 — — — 0.5

Net loss (gain) on refranchisings and dispositions of

assets — — (4.1) — 3.1 — (1.0)

Impairment on non-restaurant properties — — 2.0 — 0.3 — 2.3

Bad debt expense (recoveries), net — — 6.0 — 0.1 — 6.1

Share-based compensation — — 1.0 — 0.2 — 1.2

Deferred income taxes — 3.1 (36.8) — 6.4 — (27.3)

Changes in current assets and liabilities, excluding acquisitions

and dispositions:

Trade and notes receivables — — (9.6) — 3.6 — (6.0)

Prepaids and other current assets — — 96.4 — 9.1 — 105.5

Accounts and drafts payable — — 2.8 — 5.9 — 8.7

Accrued advertising — — 11.3 — 7.0 — 18.3

Other accrued liabilities — (2.4) 14.2 — 9.4 — 21.2

Other long-term assets and liabilities — (13.3) 11.1 — (9.7) (4.9) (16.8)

Net cash provided by (used for) operating activities 0.2 (0.2) 242.2 — 168.9 (4.9) 406.2

Payments for property and equipment — — (62.5) — (19.6) — (82.1)

Proceeds from refranchisings, disposition of assets and

restaurant closures — — 15.6 — 14.3 — 29.9

Investments in / advances to unconsolidated entities — — — — (4.5) — (4.5)

Return of investment on direct financing leases — — 13.5 — 1.1 — 14.6

Other investing activities — — 0.7 — — — 0.7

Net cash used for investing activities — — (32.7) — (8.7) — (41.4)

Proceeds from term debt — — 1,860.0 — — — 1,860.0

Proceeds from discount notes — 401.5 — — — — 401.5

Repayments of term debt and capital leases — — (1,870.8) — (3.7) — (1,874.5)

Extinguishment of debt — (7.6) (63.0) — — — (70.6)

Payment of financing costs — (9.5) (23.1) — — — (32.6)

Proceeds from issuance of shares 1.6 — — — — — 1.6

Dividends paid on common stock (385.8) — (7.6) — — — (393.4)

Intercompany financing 384.2 (384.2) 44.3 (0.7) (48.5) 4.9 —

Net cash provided by (used for) financing activities — 0.2 (60.2) (0.7) (52.2) 4.9 (108.0)

Effect of exchange rates on cash and cash equivalents — — 5.0 — (9.8) — (4.8)

Increase (decrease) in cash and cash equivalents 0.2 — 154.3 (0.7) 98.2 — 252.0

Cash and cash equivalents at beginning of period — — 132.8 0.7 73.5 — 207.0

$0.2 $ — $ 287.1 $ — $ 171.7 $ — $ 459.0

On February 12, 2014, our board declared a cash dividend of $0.07 per share, which will be paid on March 12, 2014 to shareholders of record on

February 26, 2014.

113

Source: Burger King Worldwide, Inc., 10-K, February 21, 2014 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.