Burger King 2012 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

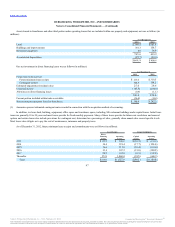

We incurred approximately $16.0 million of financing costs related to the 2012 Credit Agreement, including approximately $10.8 million recorded as

deferred financing costs, which are classified as other assets, net on the condensed consolidated balance sheets, and amortized to interest expense using the

effective interest method. The remaining fees are included in loss on early extinguishment of debt.

In connection with the 3G Acquisition of Holdings by 3G, BKC and Holdings entered into a credit agreement dated as of October 19, 2010, as amended

and restated as of February 15, 2011 (the “2011 Amended Credit Agreement”). The 2011 Amended Credit Agreement provided for (i) two tranches of term

loans in aggregate principal amounts of $1,600.0 million and €200.0 million (the “Term Loans”), each under a term loan facility (the “Term Loan Facility”)

and (ii) a senior secured revolving credit facility for up to $150.0 million of revolving extensions of credit outstanding at any time (including revolving loans,

swingline loans and letters of credit) (the “Revolving Credit Facility,” and together with the Term Loan Facility, the “Credit Facilities”). The maturity date for

the Term Loan Facility was October 19, 2016 and the maturity date for the Revolving Credit Facility was October 19, 2015. As described above, borrowings

under the 2011 Amended Credit Agreement were refinanced by the 2012 Credit Agreement.

We were allowed to prepay the Term Loans in whole or in part at any time. During 2012, we made $37.7 million in voluntary prepayments of our Term

Loans.

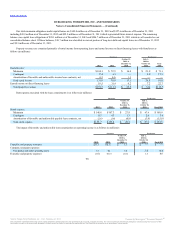

Under the Credit Facilities, BKC was required to comply with customary financial ratios and the Credit Facilities also contained a number of

customary affirmative and negative covenants. The Company was in compliance with all 2011 Amended Credit Agreement financial ratios and covenants at

the time of the refinancing in September 2012.

At December 31, 2012, we had outstanding $794.5 million of senior notes due 2018 that bear interest at a rate of 9.875% per annum, which is payable

semi-annually on October 15 and April 15 of each year (the “Senior Notes”). The Senior Notes mature on October 15, 2018. During 2012, we repurchased

and retired Senior Notes with an aggregate face value of $3.0 million for a purchase price of $3.4 million, including accrued interest. During 2011, we

repurchased and retired Senior Notes with an aggregate face value of $2.5 million for a purchase price of $2.7 million, including accrued interest.

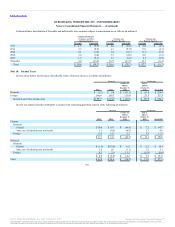

The Senior Notes are general unsecured senior obligations of BKC that rank pari passu in right of payment with all our existing and future senior

indebtedness. The Senior Notes are effectively subordinated to all our Secured Indebtedness (including the 2012 Credit Facilities) to the extent of the value of

the assets securing such indebtedness and are structurally subordinated to all indebtedness and other liabilities, including preferred stock, of non-guarantor

subsidiaries.

The Senior Notes are guaranteed by Holdings and all existing direct and indirect subsidiaries that borrow under or guarantee any indebtedness or

indebtedness of another guarantor. Additionally, in August 2012 the Company entered into a Supplemental Indenture to guarantee BKC’s obligations under the

Senior Notes. Under certain circumstances, subsidiary guarantors may be released from their guarantees without the consent of the holders of the Senior

Notes.

92

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.