Burger King 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

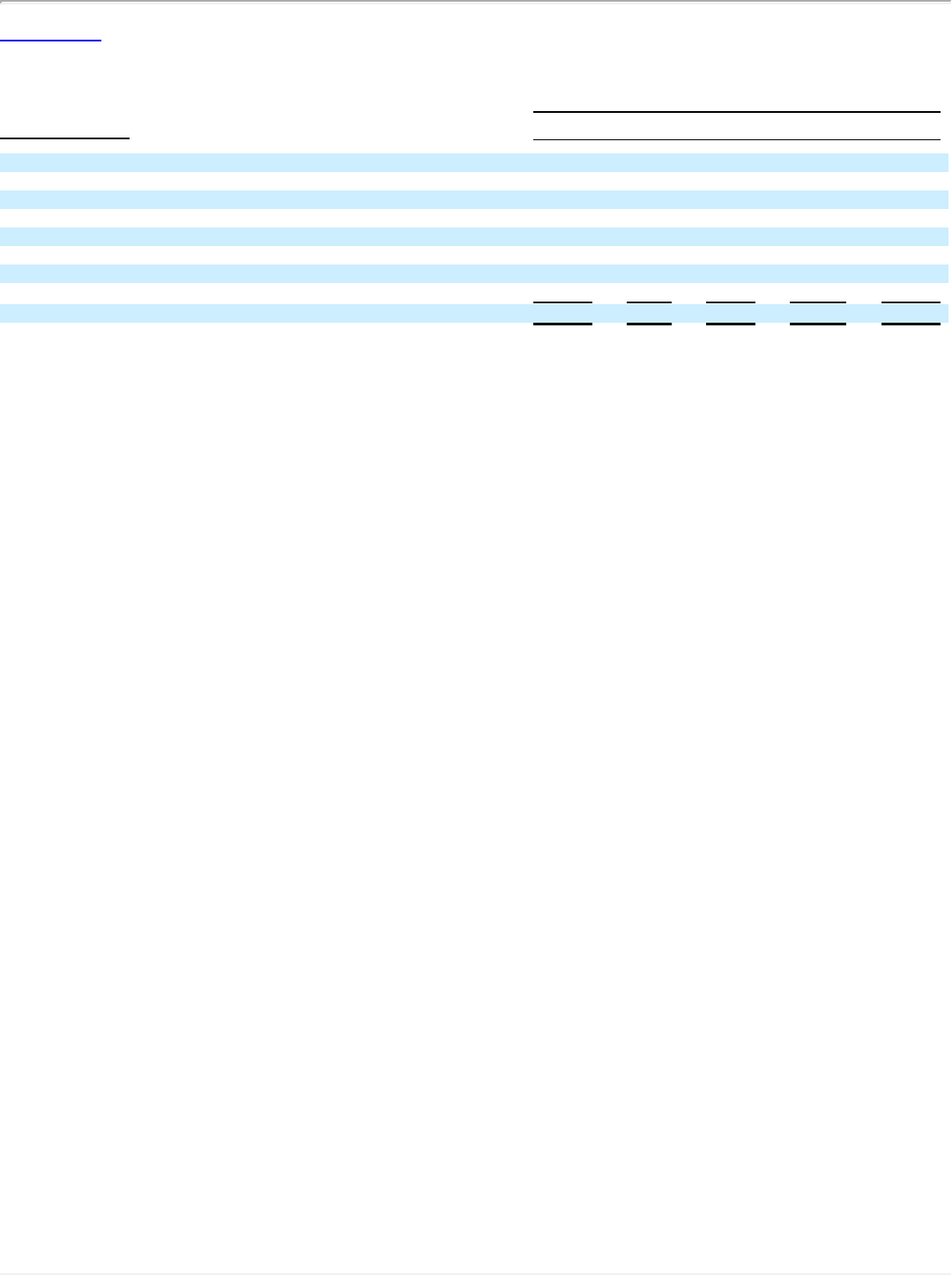

Term debt, including current portion, interest and interest rate cap premiums(1) $2,033.1 $101.0 $ 273.9 $952.6 $705.6

Senior Notes, including interest 1,245.6 78.5 156.9 156.9 853.3

Discount Notes, including PIK interest 691.1 — — — 691.1

Operating lease obligations 1,188.0 133.3 244.6 209.8 600.3

Capital lease obligations 99.1 18.2 34.1 28.3 18.5

Purchase commitments(2) 180.5 172.8 7.7 — —

Severance and severance-related costs 11.0 11.0 — — —

Unrecognized tax benefits(3) 23.3 — — — —

Total $5,471.7 $514.8 $ 717.2 $1,347.6 $2,868.8

(1) We have estimated our interest payments through the maturity of our 2012 Credit Facilities based on current LIBOR rates and the terms of our interest

rate caps.

(2) Includes open purchase orders, as well as commitments to purchase advertising and other marketing services from third parties in advance on behalf of

the system and obligations related to information technology and service agreements.

(3) We have provided only a total in the table above since the timing of the unrecognized tax benefit payments is unknown.

During the fiscal year ended June 30, 2000, we entered into long-term, exclusive contracts with soft drink vendors to supply Company and franchise

restaurants with their products and obligating Burger King restaurants in the United States to purchase a specified number of gallons of soft drink syrup.

These volume commitments are not subject to any time limit and as of December 31, 2012, we estimate it will take approximately 12 years for these purchase

commitments to be completed. In the event of early termination of this arrangement, we may be required to make termination payments that could be material to

our financial position, results of operations and cash flows.

From time to time, we enter into agreements under which we guarantee loans made by third parties to qualified franchisees. As of December 31, 2012,

there were $81.9 million of loans outstanding to franchisees that we had guaranteed under three such programs, with additional franchisee borrowing capacity

of approximately $104.0 million remaining. Our maximum guarantee liability under these three programs is limited to an aggregate of $25.3 million, assuming

full utilization of all borrowing capacity. As of December 31, 2012, the liability we recorded to reflect the fair value of these guarantee obligations was $2.7

million. No significant payments have been made by us in connection with these guarantees through December 31, 2012.

On October 28, 2012, our Board of Directors approved a cash dividend of $0.04 per share that was paid on November 29, 2012 to shareholders of

record at the close of business on November 9, 2012. On December 16, 2011, we paid a dividend to our shareholders, principally 3G, in the amount of

$393.4 million, representing the net proceeds from the sale of the Discount Notes. We paid a cash dividend of $0.0625 per share on September 30, 2010 to the

Predecessor’s shareholders of record at the close of business on September 14, 2010. Total dividends paid by the Predecessor during the period July 1, 2010 to

October 18, 2010 were $8.6 million. Total dividends paid to the Predecessor’s shareholders were $34.2 million in fiscal 2010.

59

®

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.