Burger King 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

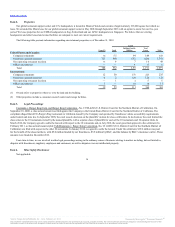

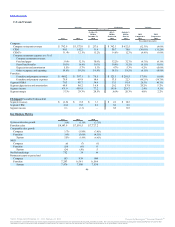

The 3G Acquisition and related financing transactions (collectively referred to as the “2010 Transactions”) as described in Note 1 to the accompanying

audited Consolidated Financial Statements were accounted for using the acquisition method of accounting, or acquisition accounting, in accordance with

Financial Accounting Standard Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 805, . During the quarter ended

December 31, 2011, we finalized our purchase price allocation on a retrospective basis as of the Acquisition Date, with corresponding adjustments to our

results of operations. Acquisition accounting resulted in certain items that affect the comparability of the results of operations between us and our Predecessor,

including changes in asset carrying values (and related depreciation and amortization).

In connection with the 2010 Transactions, we incurred costs of $3.7 million in 2011 and $94.9 million in the period October 19, 2010 to December 31,

2010, consisting of investment banking and legal fees, compensation related expenses and commitment fees associated with the bridge loan available at the

closing of the 2010 Transactions.

Additionally, our interest expense is significantly higher following the 2010 Transactions than experienced by our Predecessor in prior periods, primarily

due to the higher principal amount of debt outstanding following the 2010 Transactions, as well as higher interest rates.

On November 5, 2010, our Board of Directors approved a change in fiscal year end from June 30 to December 31. The change became effective at the

end of the quarter ended December 31, 2010. All references to “fiscal”, unless otherwise noted, refer to the twelve-month fiscal year, which prior to July 1,

2010, ended on June 30.

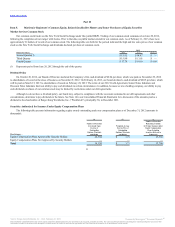

Between December 2010 and December 2011, we completed a global restructuring plan that resulted in work force reductions throughout our

organization. In June 2011, we implemented a Voluntary Resignation Severance Program (“VRS Program”) offered for a limited time to eligible employees based

at our Miami headquarters. In addition, other involuntary work force reductions were also implemented. As a result of the global restructuring plan, VRS

Program and the additional workforce reductions, we incurred $46.5 million of severance benefits and other severance related costs in 2011 and $67.2

million in the period October 19, 2010 to December 31, 2010.

During 2011, we completed a project to significantly expand and enhance our U.S. field organization to better support our franchisees in an effort to

drive sales, increase profits and improve restaurant operations (the “field optimization project”). As a result of the field optimization project, we incurred $10.6

million in 2011 of severance related costs, compensation costs for overlap staffing, travel expenses, consulting fees and training costs.

During 2011, we initiated a project to realign our global restaurant portfolio by refranchising our Company restaurants and establishing strategic

partnerships to accelerate development through joint venture structures and master franchise and development agreements (the “global portfolio realignment

project”). As a result of the global portfolio realignment project, we incurred $30.2 million in 2012 and $7.6 million in 2011 of general and administrative

expenses consisting primarily of severance and professional fees.

37

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.