Burger King 2012 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Additionally, the Predecessor was required to estimate pre-vesting forfeitures for purposes of determining compensation expense to be recognized. Future

expense amounts for any quarterly or annual period could have been affected by changes in the Predecessor’s assumptions or changes in market conditions.

The Predecessor determined the expected term of stock options granted using the simplified method. Based on the results of applying the simplified

method, the Predecessor determined that 6.25 years was an appropriate expected term for awards with four-year graded vesting.

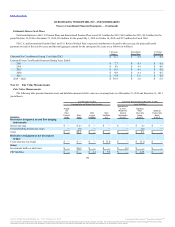

The fair value of each stock option granted under the Plans during July 1, 2010 through October 18, 2010 and for Fiscal 2010 and 2009 was estimated

on the date of grant using the Black-Scholes option pricing model based on the following weighted-average assumptions:

Risk-free interest rate 1.83% 2.92%

Expected term (in years) 6.25 6.25

Expected volatility 38.34% 37.15%

Expected dividend yield 1.43% 1.37%

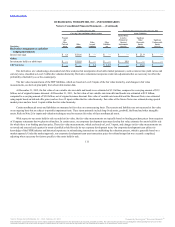

The weighted average grant date fair value of stock options granted was $6.02 during the period July 1, 2010 through October 18, 2010 and $6.56 for

Fiscal 2010. The total intrinsic value of stock options exercised was $3.2 million during the period July 1, 2010 through October 18, 2010 and $8.1 million

for Fiscal 2010. The related excess tax benefits from stock options exercised were $1.1 million offset by $1.5 million shortfalls recorded as operating cash

flows for the period July 1, 2010 through October 18, 2010 and $3.5 million for Fiscal 2010.

Proceeds from stock options exercised were $4.0 million for the period July 1, 2010 through October 18, 2010 and $4.2 million for Fiscal 2010.

The weighted average grant date fair value of nonvested shares granted was $16.96 during the period July 1, 2010 through October 18, 2010 and

$18.35 for Fiscal 2010. The total intrinsic value of grants which vested and settled was $9.1 million during the period July 1, 2010 through October 18, 2010

and $9.6 million for Fiscal 2010.

The fair value of shares withheld by us to meet employees’ minimum statutory withholding tax requirements on the settlement of RSU’s was $2.5

million during the period July 1, 2010 through October 18, 2010 and $2.7 million for Fiscal 2010.

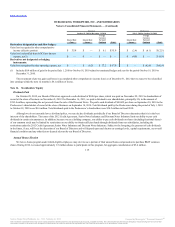

Basic earnings (loss) per share is based on net income and weighted average of common shares outstanding. For periods prior to the Merger, share count

was determined by retrospectively adjusting all Worldwide shares by the exchange ratio of 3.479129. Diluted earnings per share reflects the potential dilution

of common shares, relating to outstanding stock options and RSUs calculated using the treasury stock method. For periods prior to the Merger, outstanding

stock options and RSUs were determined by converting all Worldwide stock options to Company stock options using the exchange ratio of 3.355508 and all

Worldwide RSUs to Company RSUs using the exchange ratio of 3.479129.

119

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.