Burger King 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

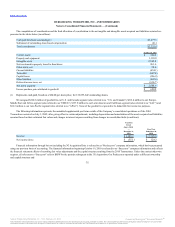

Revenues include retail sales at Company restaurants, franchise revenues and property income. Franchise revenues consist primarily of royalties, based

on a percentage of sales reported by the franchised restaurants, and initial and renewal franchise fees paid by franchisees. Property income consists of

operating lease rentals and earned income on direct financing leases on property leased or subleased to franchisees. Retail sales at Company restaurants are

recognized at the point of sale. We present sales net of sales tax and other sales-related taxes. Royalties are recognized when collectability is reasonably assured.

Initial franchise fees are recognized as revenue when the related restaurant begins operations. A franchisee may pay a renewal franchise fee and renew its

franchise for an additional term. Renewal franchise fees are recognized as revenue upon receipt of the non-refundable fee and execution of a new franchise

agreement. The cost recovery accounting method is used to recognize revenues for franchisees for which collectability is not reasonably assured. Rental income

on operating lease rentals and earned income on direct financing leases are recognized when earned and collectability is reasonably assured.

We expense the production costs of advertising when the advertisements are first aired or displayed. All other advertising and promotional costs are

expensed in the period incurred.

Franchise restaurants and Company restaurants contribute to advertising funds that we manage in the United States and certain international markets

where Company restaurants operate. Under our franchise agreements, contributions received from franchisees must be spent on advertising, marketing and

related activities, and result in no gross profit recognized. Advertising expense, net of franchisee contributions, totaled $48.3 million for 2012, $78.2 million

for 2011, $16.7 million for the period of October 19, 2010 through December 31, 2010, $25.3 million for the period of July 1, 2010 through October 18,

2010 and $91.3 million for the fiscal year ended June 30, 2010, and is included in selling, general and administrative expenses in the accompanying

consolidated statements of operations.

To the extent that contributions received exceed advertising and promotional expenditures, the excess contributions are accounted for as a deferred

liability and are recorded in accrued advertising in the accompanying consolidated balance sheets.

Franchisees in markets where no Company restaurants operate contribute to advertising funds that are not managed by us. Such contributions and

related fund expenditures are not reflected in our results of operations or financial position.

We carry insurance to cover claims such as workers’ compensation, general liability, automotive liability, executive risk and property, and we are self-

insured for healthcare claims for eligible participating employees. Through the use of insurance program deductibles (ranging from $0.1 million to

$2.5 million) and self insurance, we retain a significant portion of the expected losses under these programs. Insurance reserves have been recorded based on

our estimates of the anticipated ultimate costs to settle all claims, on an undiscounted basis, both reported and incurred-but-not-reported (IBNR).

From time to time, we are subject to proceedings, lawsuits and other claims related to competitors, customers, employees, franchisees, government

agencies and suppliers. We are required to assess the likelihood of any adverse judgments or outcomes to these matters as well as potential ranges of probable

losses. A

82

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.