Burger King 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

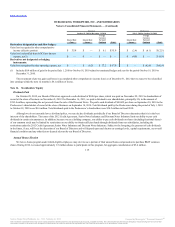

Gains and losses on closures and dispositions represent sales of Company properties and other costs related to restaurant closures and refranchisings,

and are recorded in other operating (income) expenses, net in the accompanying consolidated statements of operations. Gains and losses recognized in the

current period may reflect closures and refranchisings that occurred in previous periods.

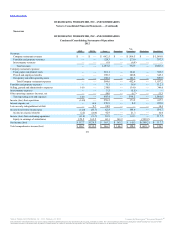

Net (gains) losses on disposal of assets, restaurant closures and refranchisings consisted of net (gains) losses associated with refranchisings,

impairment losses associated with long-lived assets for Company restaurants and net losses associated with asset disposals and restaurant closures.

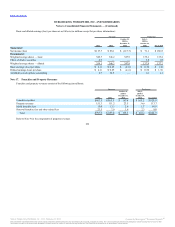

During 2012, non-cash investing activities included $98.6 million in equity method investments associated with refranchisings. Equity method

investments are classified as other assets, net in our consolidated balance sheets. Our interest in the loss from our equity method investments was not material

to our consolidated statements of operations during 2012 or 2011. Significant equity method investments in 2012 included the following:

On May 30, 2012, we completed the refranchising of 278 Company restaurants to Carrols Restaurant Group, Inc. (“Carrols”), including the

assignment to Carrols of our right of first refusal on franchise sales of restaurants in 20 states. Total consideration included a 28.9% equity

interest in Carrols and total cash payments of approximately $16.2 million, of which approximately $4.0 million, associated with a right of first refusal, is

payable over five years. We recorded a net loss of $4.4 million associated with this refranchising.

In May 2012, we completed the acquisition of the equity interests we did not previously hold in two former equity method investments in China for total

consideration of $17.3 million. In June 2012, we contributed the equity interests in our 44 Company restaurants in China, including the 22 restaurants we

acquired in May 2012, to an entity established to develop the China market (the “China Venture”). Total consideration received by the Company in exchange

for these contributions included a significant minority equity interest in the China Venture and a cash payment of approximately $2.2 million. The aggregate

gain related to the acquisition of the majority interest in the former equity method investments in China and the contribution of the 44 restaurants to the China

Venture was $26.4 million during 2012 and is included in net (gains) losses on disposal of assets, restaurant closures and refranchisings.

We guarantee certain lease payments of franchisees arising from leases assigned in connection with sales of Company restaurants to franchisees, by

remaining secondarily liable for base and contingent rents under the assigned leases of varying terms. The maximum contingent rent amount is not

determinable as the amount is based on future revenues. In the event of default by the franchisees, we have typically retained the right to acquire possession of

the related restaurants, subject to landlord consent. The aggregate contingent obligation arising from these assigned lease guarantees, excluding contingent rents,

was $48.8 million as of December 31, 2012, expiring over an average period of six years.

From time to time, we enter into agreements under which we guarantee loans made to qualified franchisees. As of December 31, 2012, there were $81.9

million of loans outstanding to franchisees that we had guaranteed under three such programs, with additional franchisee borrowing capacity of approximately

$104.0 million remaining. Our maximum guarantee liability under these three programs is limited to an aggregate of

122

®

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.