Burger King 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

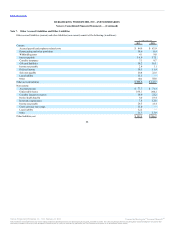

actuarial present value of benefits expected to be paid upon retirement. For postretirement benefit plans, the benefit obligation represents the actuarial present

value of postretirement benefits attributed to employee services already rendered. Gains or losses and prior service costs or credits related to our pension plans

are being recognized as they arise as a component of other comprehensive income (loss) to the extent they have not been recognized as a component of net

periodic benefit cost.

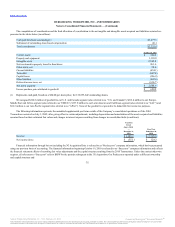

We sponsor the Burger King Savings Plan (the “Savings Plan”), a defined contribution plan under the provisions of Section 401(k) of the Internal

Revenue Code. The Savings Plan is voluntary and is provided to all employees who meet the eligibility requirements. A participant can elect to contribute up to

50% of their compensation, subject to IRS limits, and we match 100% of the first 4% of employee compensation.

We also maintain an Executive Retirement Plan (“ERP”) for all officers and senior management. Prior to December 31, 2010, officers and senior

management could elect to defer up to 75% of base pay once 401(k) limits were reached and up to 100% of incentive pay on a before-tax basis under the ERP.

BKC provided a dollar-for-dollar match up to the first 6% of base pay. In the quarter ended December 31, 2010, we elected to cease further participation

deferrals and contributions to the ERP.

Aggregate amounts recorded in the consolidated statements of operations representing our contributions to the Savings Plan and the ERP on behalf of

restaurant and corporate employees was $1.8 million for 2012, $4.2 million for 2011, $0.8 million for the period of October 19, 2010 through December 31,

2010, $2.7 million for the period of July 1, 2010 through October 18, 2010 and $6.7 million for Fiscal 2010. Our contributions made on behalf of restaurant

employees are classified as payroll and employee benefit expenses in our consolidated statements of operations, while our contributions made on behalf of

corporate employees are classified as selling, general and administrative expenses in our consolidated statements of operations.

During 2012, we adopted an accounting standards update that amends accounting guidance to allow us to first assess qualitative factors to determine

whether it is necessary to perform the two-step quantitative goodwill impairment test. Under these amendments, we are not required to calculate the fair value of

a reporting unit unless we determine, based on a qualitative assessment, that it is more likely than not that its fair value is less than its carrying amount. The

amendments include a number of events and circumstances for an entity to consider in conducting the qualitative assessment. The adoption of this accounting

standard update did not have an impact on our consolidated financial position, results of operations or cash flows.

During 2012, we adopted an accounting standards update that amends accounting guidance to achieve common fair value measurement and disclosure

requirements under GAAP and international financial reporting standards (“IFRS”). The amendments in this accounting standard clarify the intent of the

Financial Accounting Standards Board (“FASB”) about the application of existing fair value measurement requirements. The amendments change the wording

used to describe many of the requirements in GAAP for disclosing information about fair value measurements. The adoption of this accounting standard

update did not have a material effect on our consolidated financial position, results of operations or cash flows.

During 2012, we adopted an accounting standards update that requires us to present the total of comprehensive income, the components of net income,

and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive

statements. This standard eliminates the option to present the components of other comprehensive income as part of the statement of equity. The consolidated

statements of comprehensive income (loss) and disclosures required by this accounting standard update are included in this Form 10-K.

84

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.