Burger King 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

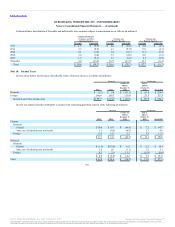

dissolutions; sell assets (with exceptions for, among other things, sales of Company restaurants to existing or prospective franchisees and sales of real estate,

subject to achievement of specified total leverage ratios in the case of real estate sales); pay dividends and make other payments in respect of capital stock;

make investments, loans and advances; pay and modify the terms of certain indebtedness; engage in certain transactions with affiliates; enter into certain

speculative hedging arrangements; enter into negative pledge clauses and clauses restricting subsidiary distributions; and change its line of business. In

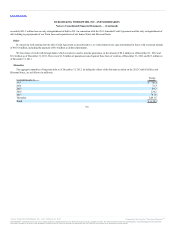

addition, under the 2012 Credit Facilities, BKC will be required to maintain a specified minimum interest coverage ratio and may not exceed a specified

maximum total leverage ratio.

The 2012 Credit Facilities contain customary events of default, including nonpayment of principal, interest, fees or other amounts; material inaccuracy

of a representation or warranty when made; violation of a covenant; cross-default to material indebtedness; bankruptcy events; certain ERISA events; material

unsatisfied judgments; actual or asserted invalidity of any guarantee, security document or subordination provisions; non-perfection of security interest;

changes in the passive holding company status of Holdings; and a change of control. BKC’s ability to borrow under the 2012 Credit Facilities will be

dependent on, among other things, its compliance with the above-described covenants and financial ratios. Failure to comply with these covenants, ratios or

the other provisions of the 2012 Credit Facilities (subject to certain grace periods) could, absent a waiver or an amendment from the lenders under such

agreement, restrict the availability of the 2012 Revolving Credit Facility and permit the acceleration of all outstanding borrowings under the 2012 Credit

Facility. There are no provisions in the 2012 Credit Agreement that could accelerate payment of debt as a result of a change in credit ratings.

At December 31, 2012, we were in compliance with all covenants of the 2012 Credit Agreement and there were no limitations on our ability to draw on

the remaining availability under the 2012 Revolving Credit Facility.

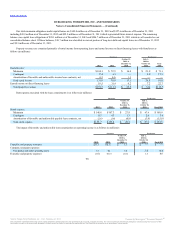

In connection with the 2012 Credit Facilities, the Company entered into a Guarantee Agreement (the “Guarantee Agreement”), dated as of September 28,

2012 in favor of JPMorgan Chase Bank, N.A., as administrative agent, pursuant to which the Company guaranteed amounts borrowed under the 2012 Credit

Facilities. Holdings, BKC and certain of BKC’s subsidiaries (the “Subsidiary Guarantors”) entered into a Guarantee and Collateral Agreement (the “Guarantee

and Collateral Agreement”), dated as of September 28, 2012 in favor of JPMorgan Chase Bank, N.A. as administrative agent. Pursuant to the Guarantee and

Collateral Agreement, Holdings and the Subsidiary Guarantors guaranteed amounts borrowed under the 2012 Credit Facilities. Additionally, amounts

borrowed under the 2012 Credit Facilities and any swap agreements and cash management arrangements provided by any lender party to the 2012 Credit

Facilities or any of its affiliates are secured on a first priority basis by a perfected security interest in substantially all of Holdings’, BKC’s and each

Subsidiary Guarantor’s tangible and intangible assets (subject to certain exceptions), including U.S. registered intellectual property, owned real property over

$10 million in value and all of the capital stock of BKC and each of its direct and indirect restricted subsidiaries (limited, in the case of foreign subsidiaries,

to 65%, of the capital stock of first tier foreign subsidiaries).

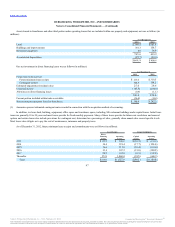

We are required to pay certain recurring fees with respect to the 2012 Credit Facilities, including (i) fees on the unused commitments of the lenders under

the revolving facility, (ii) letters of credit fees on the aggregate face amounts of outstanding letters of credit plus a fronting fee to the issuing bank and

(iii) administration fees. Amounts outstanding under the 2012 Revolving Credit Facility bear interest at a rate equal to 3.25% and 3.50% on the amount drawn

under each letter of credit that is issued and outstanding under the 2012 Revolving Credit Facility. The interest rate on the unused portion of the 2012

Revolving Credit Facility ranges from 0.50% to 0.75%, depending on our leverage ratio, and our current rate is 0.50%.

91

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.