Burger King 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

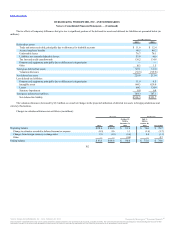

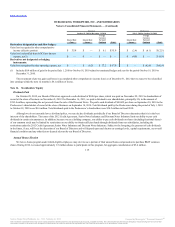

At December 31, 2012, assets held for sale totaled $23.9 million and consisted primarily of goodwill and machinery and equipment to be sold in

connection with refranchisings. We did not have assets classified as held for sale at December 31, 2011. Assets held for sale are included with Prepaids and

Other Current Assets, net in our consolidated balance sheets.

We assess the fair value less costs to sell of assets held for sale each reporting period they remain classified as held for sale. We report subsequent

changes in the fair value less costs to sell of assets held for sale as an adjustment to the carrying amount of the assets held for sale. However, the adjusted

carrying amount cannot exceed the carrying amount of the long-lived asset at the time it was initially classified as held for sale. During 2012, we recorded

impairment losses of $13.2 million associated with long-lived assets for Company restaurants we classified as held for sale in the U.S. We did not record any

impairment charges associated with assets held for sale during 2011.

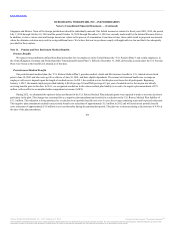

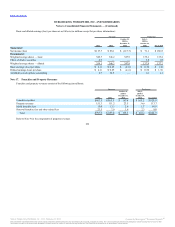

We enter into derivative instruments for risk management purposes, including derivatives designated as cash flow hedges, derivatives designated as net

investment hedges and those utilized as economic hedges. We use derivatives to manage exposure to fluctuations in interest rates and currency exchange rates.

See Note 12 for fair value measurements of our derivative instruments.

At December 31, 2012 and December 31, 2011, we had U.S. Dollar denominated interest rate cap agreements (notional amount of $1.4 billion and

$1.5 billion, respectively) (the “Cap Agreements”) to effectively cap the LIBOR applicable to our variable rate borrowings at a weighted-average rate of 1.74%

for U.S. Dollar denominated borrowings. The six year interest rate cap agreements are a series of individual caplets that reset and settle quarterly consistent

with the payment dates of our LIBOR-based term debt. During 2012, we terminated our Euro denominated interest rate cap agreements (notional amount of

€193.6 million at December 31, 2011) which effectively capped the annual interest expense applicable to our borrowings under the 2011 Amended Credit

Agreement for Euro denominated borrowings. In connection with the termination of the Euro denominated interest rate cap agreements, we recorded a charge of

$8.4 million within other operating (income) expense, net related to realized losses reclassified from accumulated other comprehensive income (“AOCI”).

Under the terms of the Cap Agreements, if LIBOR resets above a strike price, we will receive the net difference between the rate and the strike price. As

disclosed in Note 8, we have elected our applicable rate per annum as Eurocurrency. In addition, on the quarterly settlement dates, we will remit the deferred

premium payment (plus interest) to the counterparty, whether LIBOR resets above or below the strike price.

The Cap Agreements are designated as cash flow hedges and to the extent they are effective in offsetting the variability of the variable rate interest

payments, changes in the derivatives’ fair values are not included in current earnings but are included in accumulated other comprehensive income (AOCI) in

the accompanying condensed consolidated balance sheets. At each cap maturity date, the portion of fair value attributable to the matured cap will be

reclassified from AOCI into earnings as a component of interest expense.

From time to time as we prepay portions of the 2012 Term Loan Facility, we may modify our interest rate cap to reduce the notional amount. The terms

of the caps will not otherwise be revised by these modifications. On the modification date, the portion of the fair value attributable to the modified cap will be

reclassified from AOCI into earnings as a component of interest expense.

112

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.