Burger King 2012 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

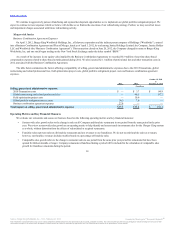

Our effective tax rate was 26.3% in 2012, primarily as a result of the current mix of income from multiple tax jurisdictions, the release of valuation

allowance and the impact of costs on refranchisings primarily in foreign jurisdictions.

Our effective tax rate was 23.2% in 2011 compared to 45.5% in 2010 as a result of the current mix of income from multiple tax jurisdictions and the

2010 Transactions.

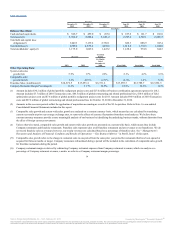

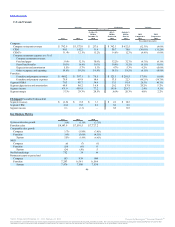

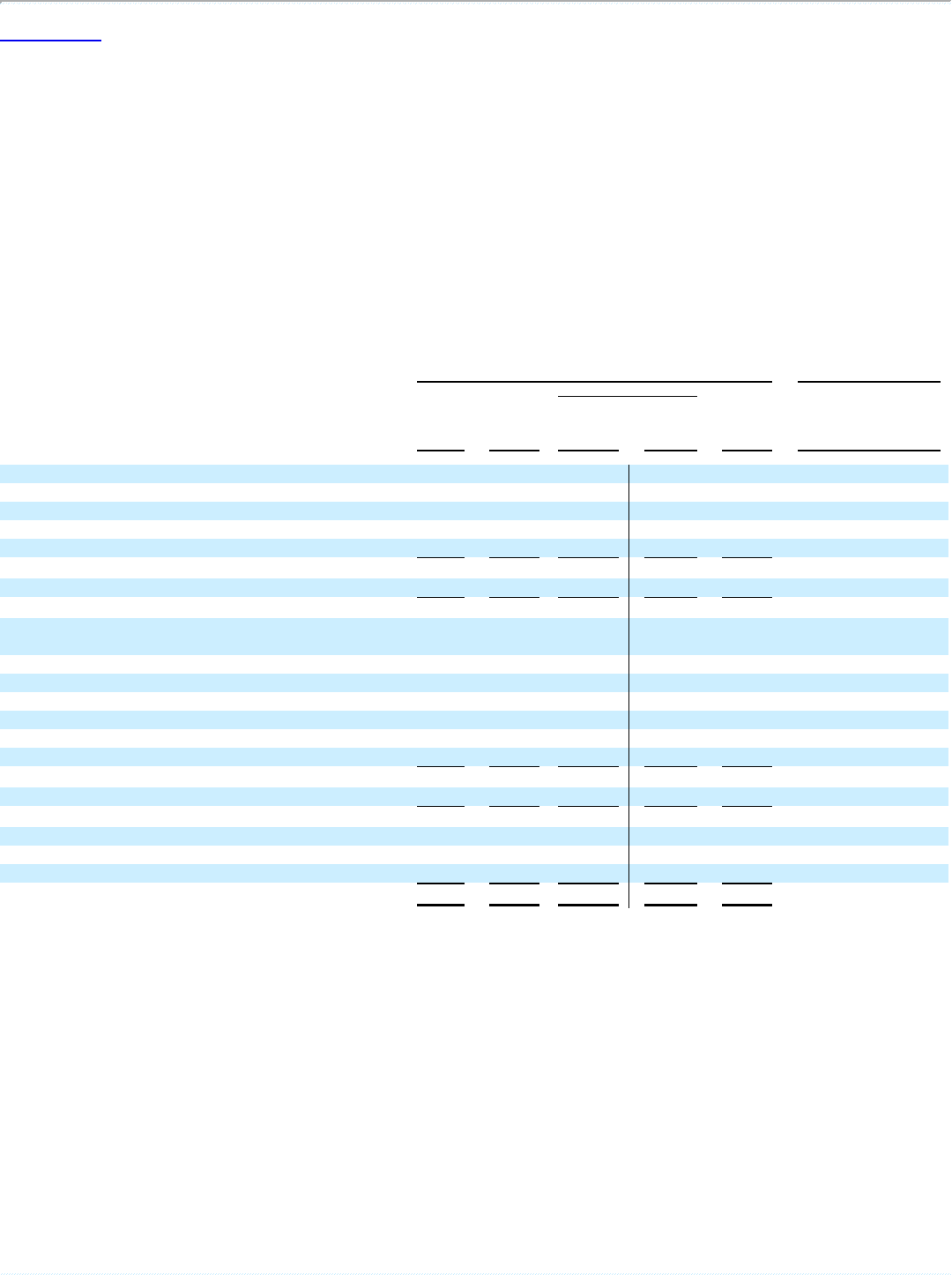

The table below contains information regarding EBITDA and Adjusted EBITDA, which are non-GAAP measures. EBITDA is defined as net income

(loss) before depreciation and amortization, interest expense, net, loss on early extinguishment of debt and income tax expense. Adjusted EBITDA is defined as

EBITDA excluding the impact of share-based compensation and non-cash incentive compensation expense, other operating (income) expenses, net, and all

other specifically identified costs associated with non-recurring projects, including 2010 Transaction costs, global restructuring and related professional fees,

field optimization project costs, global portfolio realignment project costs and business combination agreement expenses. Adjusted EBITDA is used by

management to measure operating performance of the business, excluding specifically identified items that management believes do not directly reflect our core

operations, and represents our measure of segment income.

Segment income:

U.S. and Canada $471.0 $459.9 $ 77.2 $145.0 $219.7 2.4% 4.1%

EMEA 166.1 146.0 20.1 30.8 36.9 13.8% 66.3%

Latin America 73.2 63.9 9.5 12.3 22.3 14.6% 44.9%

APAC 41.1 26.7 4.9 7.1 9.5 53.9% 24.2%

Total 751.4 696.5 111.7 195.2 288.4 7.9% 17.0%

Unallocated Management G&A (99.3) (111.5) (16.5) (60.3) (64.9) 10.9% 21.3%

Adjusted EBITDA 652.1 585.0 95.2 134.9 223.5 11.5% 29.0%

Share-based compensation and non-cash incentive compensation

expense 10.2 6.4 — 5.8 8.3 (59.4)% 54.6%

2010 Transaction costs — 3.7 94.9 — — 100.0% 96.1%

Global restructuring and related professional fees — 46.5 67.2 — — 100.0% 30.8%

Field optimization project costs — 10.6 — — — 100.0% NM

Global portfolio realignment project costs 30.2 7.6 — — — (297.4)% NM

Business combination agreement expenses 27.0 — — — — NM NM

Other operating (income) expenses, net 53.3 11.3 (8.7) (3.6) (5.8) (371.7)% 162.4%

EBITDA 531.4 498.9 (58.2) 132.7 221.0 6.5% 68.8%

Depreciation and amortization 113.7 136.4 27.6 31.2 59.3 16.6% (15.5)%

Income (loss) from operations 417.7 362.5 (85.8) 101.5 161.7 15.2% 104.3%

Interest expense, net 223.8 226.7 58.1 14.6 23.9 1.3% (134.7)%

Loss on early extinguishment of debt 34.2 21.1 — — — (62.1)% NM

Income tax expense (benefit) 42.0 26.6 (28.2) 15.8 47.8 (57.9)% 24.9%

Net income (loss) $117.7 $ 88.1 $(115.7) $ 71.1 $90.0 33.6% 94.1%

NM — Not Meaningful

44

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.