Burger King 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

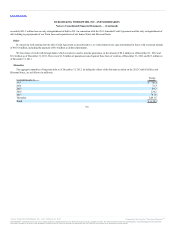

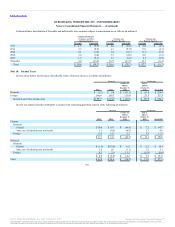

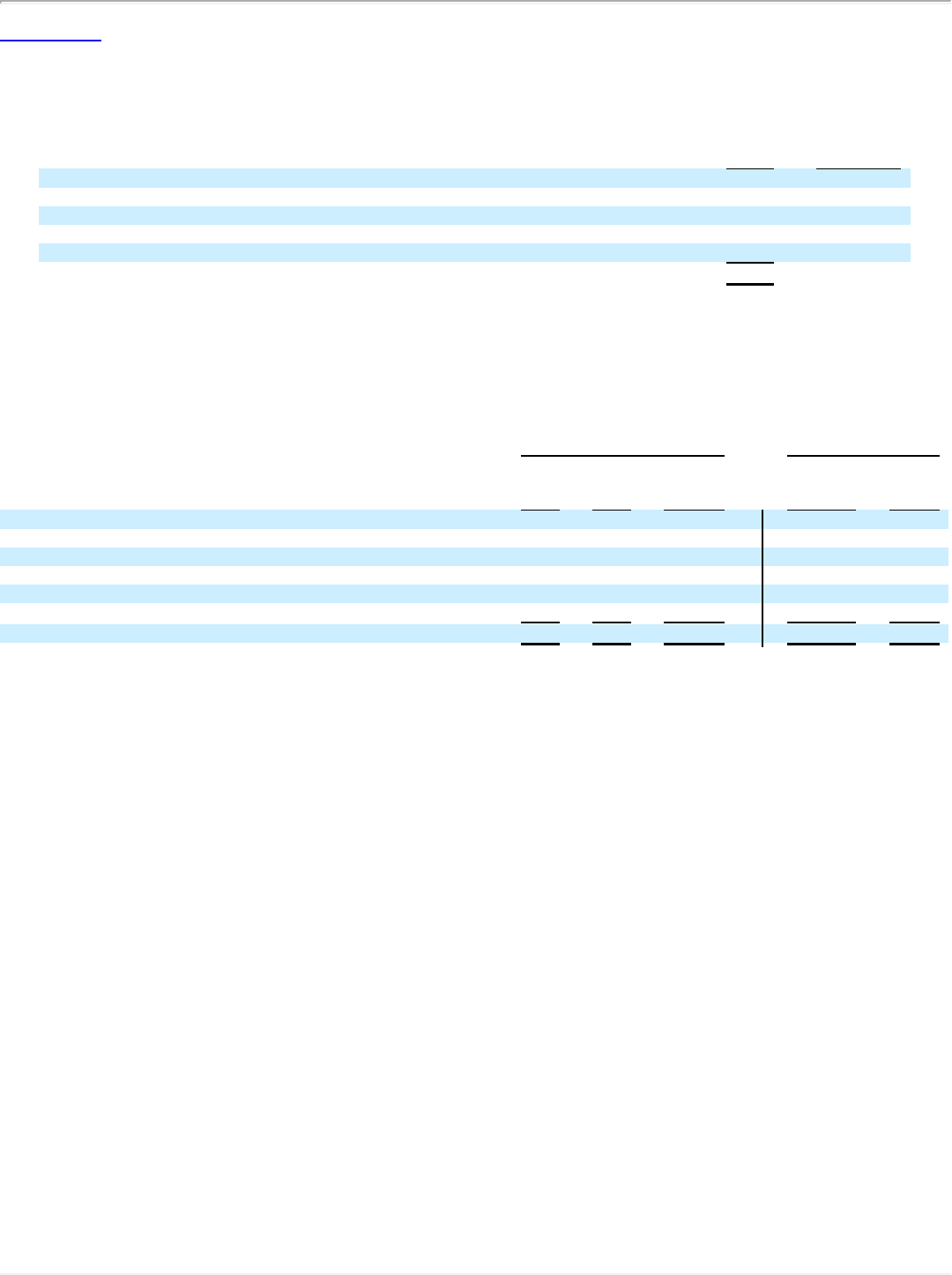

The amount and expiration dates of operating loss and tax credit carryforwards as of December 31, 2012 are as follows (in millions):

U.S. federal net operating loss carryforwards $52.8 2031 – 2032

Non-U.S. net operating loss carryforwards 256.3 2013 – 2032

Non-U.S. net operating loss carryforwards 180.5 Indefinite

State net operating loss carryforwards 132.8 2015 – 2032

U.S. foreign tax credits 17.7 2015 – 2022

Total $640.1

During 2012, the company provided for $1.0 million of taxes on $2.6 million of foreign undistributed earnings of certain subsidiaries that are expected

to be repatriated. Deferred tax liabilities have not been provided on approximately $355.1 million of undistributed earnings that are considered to be

permanently reinvested. Determination of the deferred income tax liability on these unremitted earnings is not practicable. Such liability, if any, depends on

circumstances existing if and when remittance occurs.

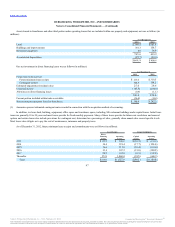

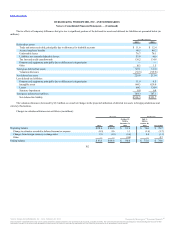

We had $23.3 million of unrecognized tax benefits at December 31, 2012, which if recognized, would favorably affect the effective income tax rate. A

reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows (in millions):

Beginning balance $21.6 $22.4 $ 22.2 $14.2 $15.5

Additions on tax position related to the current year 1.9 1.4 0.3 0.3 1.2

Additions for tax positions of prior years 0.9 2.8 — 0.3 2.7

Reductions for tax positions of prior year (0.5) (2.9) (0.1) (2.6) (2.0)

Reductions for settlement (0.5) (2.0) — — (2.0)

Reductions due to statute expiration (0.1) (0.1) — — (1.2)

Ending balance $23.3 $21.6 $22.4 $ 12.2 $14.2

During the twelve months beginning January 1, 2013, it is reasonably possible we will reduce unrecognized tax benefits by approximately $0.5 million,

primarily as a result of the expiration of certain statutes of limitations and the resolution of audits.

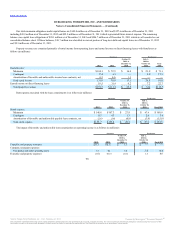

We recognize interest and penalties related to unrecognized tax benefits in income tax expense. The total amount of accrued interest and penalties was

$3.5 million at December 31, 2012 and $3.2 million at December 31, 2011. Potential interest and penalties associated with uncertain tax positions recognized

during the year ended December 31, 2012 was $0.3 million, zero during the year ended December 31, 2011, $0.1 million for the period October 19, 2010

through December 31, 2010, $0.1 million for the period July 1, 2010 through October 18, 2010 and $0.6 million for the fiscal year ended June 30, 2010. To

the extent interest and penalties are not assessed with respect to uncertain tax positions, amounts accrued will be reduced and reflected as a reduction of the

overall income tax provision.

We file income tax returns, including returns for its subsidiaries, with federal, state, local and foreign jurisdictions. Generally we are subject to routine

examination by taxing authorities in these jurisdictions, including significant international tax jurisdictions, such as the United Kingdom, Germany, Spain,

Switzerland,

103

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.