Burger King 2012 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

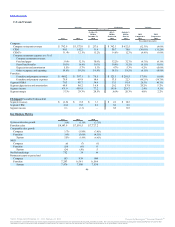

During 2012 and 2011, segment margin increased primarily as a result of the higher contribution of franchise and property revenues in the segment,

which yield higher margins than Company restaurant revenues, following the refranchisings in 2012 and franchise NRG in both periods and an increase in

CRM%.

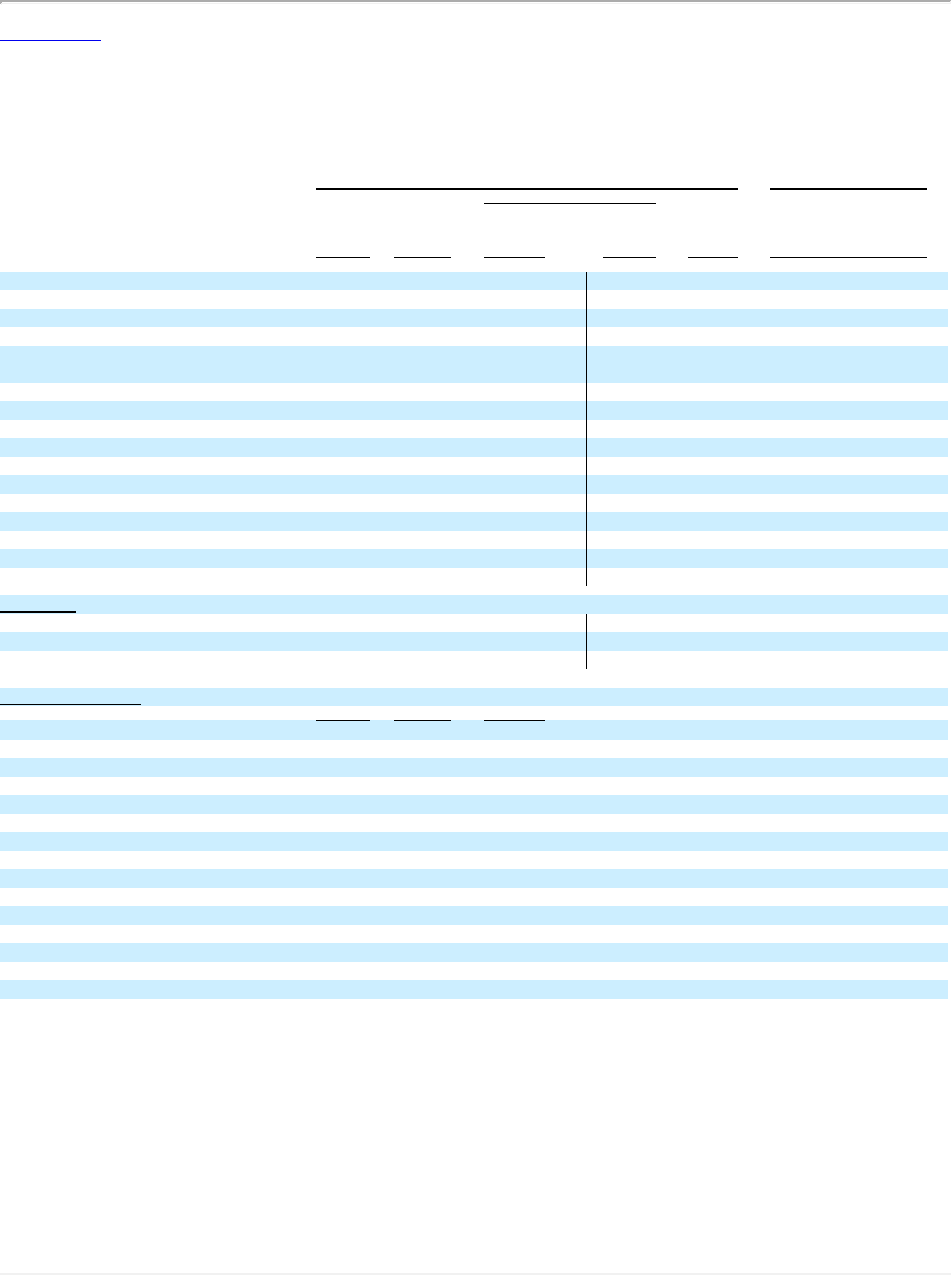

Company:

Company restaurant revenues $62.5 $66.2 $13.1 $18.3 $30.2 (5.6)% 7.5%

CRM 9.9 12.5 1.5 3.4 5.6 (20.8)% 19.0%

CRM % 15.8% 18.9% 11.5% 18.6% 18.5% (3.0)% 1.8%

Company restaurant expenses as a % of

Company restaurant revenues:

Food and paper 38.8% 38.2% 38.6% 39.3% 38.7% (0.6)% 0.7%

Payroll and benefits 12.9% 12.0% 12.2% 11.9% 11.9% (0.9)% (0.1)%

Depreciation and amortization 9.3% 9.7% 13.1% 8.0% 8.5% 0.4% (0.4)%

Other occupancy and operating 23.2% 21.2% 24.7% 22.3% 22.3% (2.0)% 1.6%

Franchise:

Franchise and property revenues $71.9 $61.9 $11.7 $15.7 $ 24.9 16.2% 18.4%

Franchise and property expenses — (1.1) — 1.3 — 100.0% 184.6%

Segment SG&A 14.6 18.3 5.5 7.0 10.9 20.2% 21.8%

Segment depreciation and amortization 6.0 6.7 1.8 1.5 2.7 10.4% (11.7)%

Segment income 73.2 63.9 9.5 12.3 22.3 14.6% 44.9%

Segment margin 54.5% 49.9% 38.3% 36.2% 40.5% 4.6% 11.2%

Favorable/(Unfavorable)

Segment revenues $(3.7) $ 1.1 $ 0.6 $0.7 $2.4

Segment CRM (0.6) 0.2 0.1 0.1 0.4

Segment income (0.4) — (0.1) 0.1 0.4

System-wide sales growth 9.9% 13.5% 13.9%

Franchise sales $1,334.1 $1,208.7 $1,060.6

Comparable sales growth

Company 0.6% 4.3% (2.9)%

Franchise 5.9% 8.1% 4.2%

System 5.7% 7.9% 3.8%

NRG

Company 3 1 2

Franchise 165 81 33

System 168 82 35

Net Refranchisings — — —

Restaurant counts at period end

Company 100 97 96

Franchise 1,290 1,125 1,044

System 1,390 1,222 1,140

50

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.