Burger King 2012 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2012 Burger King annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

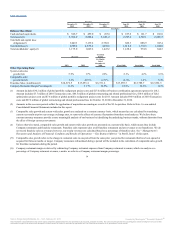

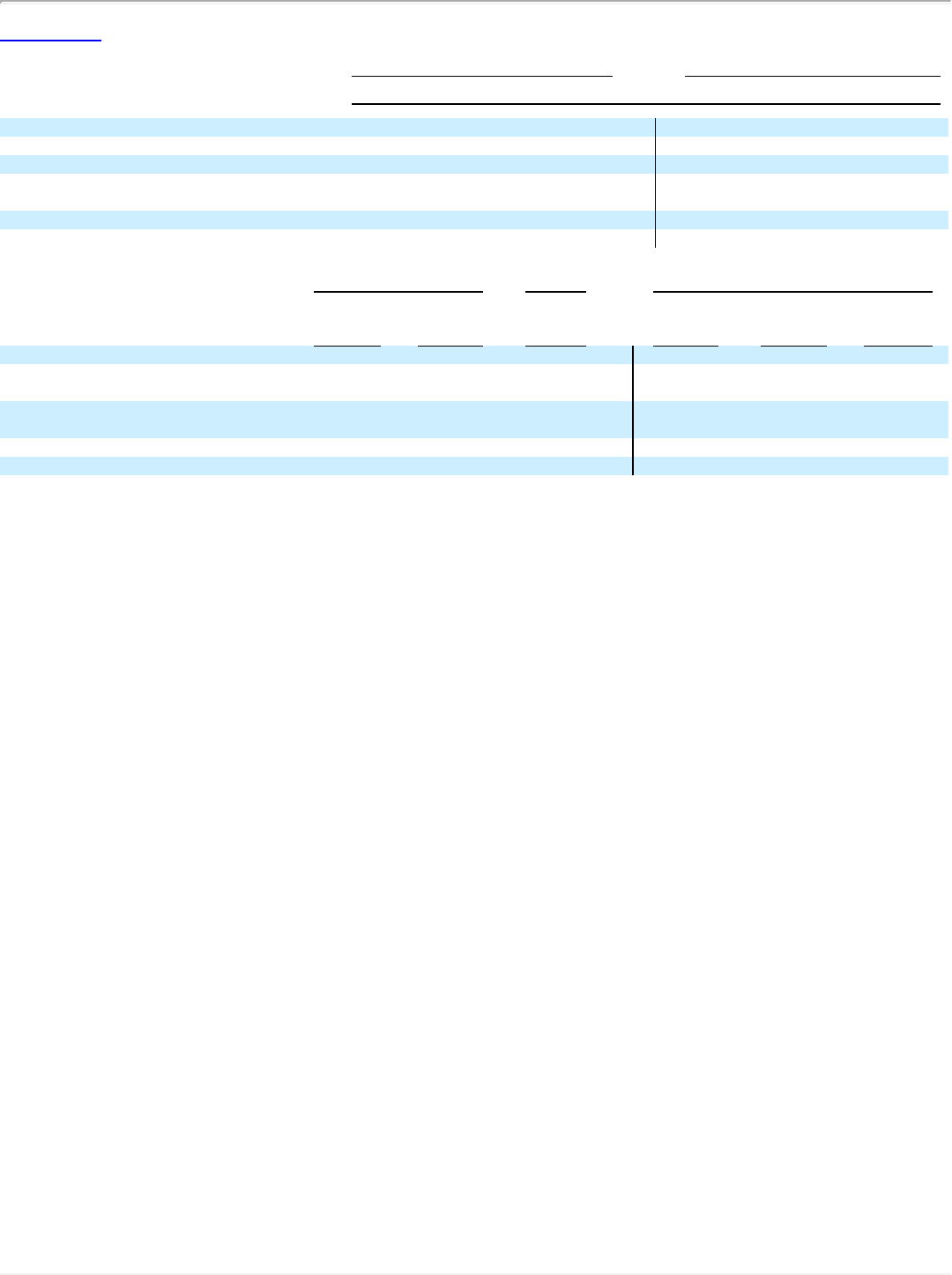

Cash and cash equivalents $546.7 $ 459.0 $207.0 $187.6 $ 121.7 $166.0

Total assets(2) 5,564.0 5,608.4 5,686.2 2,747.2 2,707.1 2,686.5

Total debt and capital lease

obligations(2) 3,049.3 3,139.2 2,792.1 826.3 888.9 947.4

Total liabilities(2) 4,389.0 4,559.2 4,239.0 1,618.8 1,732.3 1,842.0

Total stockholders’ equity(2) 1,175.0 1,049.2 1,447.2 1,128.4 974.8 844.5

System-wide sales

growth(3)(4) 5.9% 1.7% 2.2% 2.1% 4.2% 8.3%

Comparable sales

growth(3)(4)(5) 3.2% (0.5)% (2.7)% (2.3)% 1.2% 5.4%

Franchise Sales (in millions)(4) $14,672.5 $13,653.4 $6,721.2 $13,055.3 $12,788.7 $12,892.5

Company Restaurant Margin Percentage(6) 11.3% 11.7% 12.9% 12.2% 12.6% 14.3%

(1) Amount includes $30.2 million of global portfolio realignment project costs and $27.0 million of business combination agreement expenses for 2012.

Amount includes $3.7 million of 2010 Transaction costs, $46.5 million of global restructuring and related professional fees, $10.6 million of field

optimization project costs and $7.6 million of global portfolio realignment project costs for 2011. Amount includes $94.9 million of 2010 Transaction

costs and $67.2 million of global restructuring and related professional fees for October 19, 2010 to December 31, 2010.

(2) Amounts in the successor periods reflect the application of acquisition accounting as a result of the 3G Acquisition. Refer to Note 1 to our audited

Consolidated Financial Statements included in this report.

(3) Comparable sales growth and system-wide sales growth are analyzed on a constant currency basis, which means they are calculated by translating

current year results at prior year average exchange rates, to remove the effects of currency fluctuations from these trend analyses. We believe these

constant currency measures provide a more meaningful analysis of our business by identifying the underlying business trends, without distortion from

the effect of foreign currency movements.

(4) Unless otherwise stated, comparable sales growth and system-wide sales growth are presented on a system-wide basis, which means they include

Company restaurants and franchise restaurants. Franchise sales represent sales at all franchise restaurants and are revenues to our franchisees. We do

not record franchise sales as revenues; however, our royalty revenues are calculated based on a percentage of franchise sales. See “

” in Part II, Item 7 of this report.

(5) Comparable sales growth refers to the change in restaurant sales in one period from the same prior year period for restaurants that have been opened or

acquired for thirteen months or longer. Company restaurants refranchised during a period will be included in the calculation of comparable sales growth

for franchise restaurants during the period.

(6) Company restaurant margin is derived by subtracting Company restaurant expenses from Company restaurant revenues, which we analyze as a

percentage of Company restaurant revenues, a metric we refer to as Company restaurant margin percentage.

34

Source: Burger King Worldwide, Inc., 10-K, February 22, 2013 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this

information, except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.