BMW 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

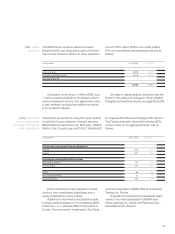

Intangible assets mainly comprise capitalised de-

velopment costs on vehicle and engine projects as

well as subsidies for tool costs, licences, purchased

development projects and software. Amortisation

on intangible assets is presented in cost of sales,

administrative costs and research and development

costs.

Goodwill of euro 33 million was recognised in

conjunction with the first-time consolidation of entory

AG, Ettlingen and its subsidiaries, Silverstroke AG,

Ettlingen and entory S.A. Luxembourg, Luxembourg.

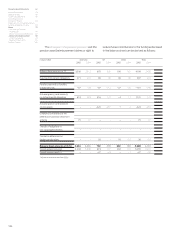

A break-down of the different classes of property,

plant and equipment disclosed in the balance sheet

and changes during the year are shown in the analy-

sis of changes in Group tangible, intangible and in-

vestment assets on pages 90 and 93.

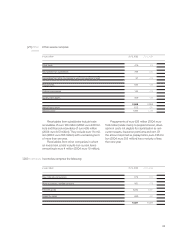

Property, plant and equipment include leased

buildings, plant and machinery and other equipment

amounting to euro 205 million (2004: euro 223 mil-

lion) which relate primarily to the Oxford and Hams

Hall production plants. Due to the nature of the lease

arrangements (finance leases), economic ownership

of these assets is attributable to the Group. The

leases for plant and machinery and other equipment

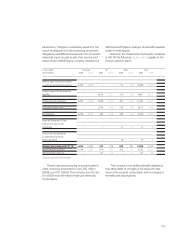

This item is not presented separately in the BMW

Group balance sheet since the amount is not sig-

nificant in relation to either the balance sheet total

or intangible assets. In addition, the reversal of im-

pairment losses amounting to euro 53 million was

recognised on intangible assets; this amount is in-

cluded in Reconcilations in the analysis of segment

information by business segment.

Changes in intangible assets during the year are

shown in the analysis of changes in Group tangible,

intangible and investment assets on pages 90and 93.

at the Oxford production plant, with a carrying amount

of euro77 million (2004: euro 111 million) at 31 De-

cember, run for periods up to 2013 at the latest.

For each of the leases, there is a recurring option to

extend the leases by one year. A purchase option

was not agreed. The lease for plant and machinery

and other facilities, factory and office equipment

at the Hams Hall production plant, with a carrying

amount of euro 38 million (2004: euro 88 million) runs

until 2018 and may be extended for one year periods

thereafter. A purchase option was not agreed.

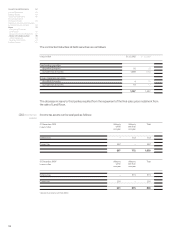

Minimum lease payments of the relevant leases

are as follows:

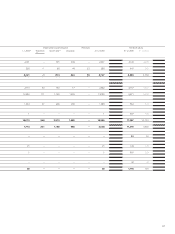

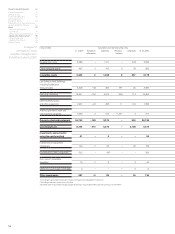

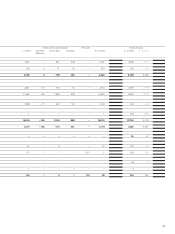

[20]Intangible

assets

[21]Property, plant

and equipment

in euro million 31.12.2005 31.12.2004

Total of future minimum lease payments

due within one year 95 79

due between one and five years 494 340

due later than five years 298 410

887 829

Interest portion of the future minimum lease payments

due within one year 19 20

due between one and five years 78 72

due later than five years 113 122

210 214

Present value of future minimum lease payments

due within one year 76 59

due between one and five years 416 268

due later than five years 185 288

677 615

Group Financial Statements 62

Income Statements 63

Balance Sheets 64

Cash Flow Statements 66

Group Statement of

Changes in Equity 68

Statement of Income and Expenses

recognised directly in Equity 69

Notes 70

--Accounting Principles

and Policies 70

--Notes to the Income Statement 81

--Notes to the balance sheet 90

--Other Disclosures 114

--Segment Information 121

Auditors’ Report 125