BMW 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.45

primarily by prior year tax reimbursements and

lower tax rates in a number of countries. In addition,

allowances on deferred tax assets were partially

reversed as a result of a renewed assessment of

recoverability in the light of the utilisation of capital

allowances in the United Kingdom.

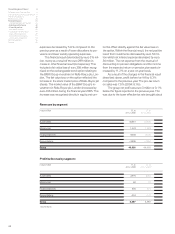

The Automobiles segment recorded a 9.9%

increase in sales volume and a 7.8% increase in

revenues. The increase in revenues was affected by

product mix shifts. Segment profit fell by 5.9% as

a consequence of the adverse external factors de-

scribed above.

Revenues of the Motorcycles segment went

up by 18.9% on the back of volume growth. Seg-

ment profit improved by 93.5%. The R1200 RT and

K1200 S, introduced in conjunction with the seg-

ment’s product initiative, and the R1200 GS, all con-

tributed well to improved profitability.

The Financial Services segment was again able

to expand business successfully in 2005 as a result

of which segment profit advanced impressively by

17.5%.

As in 2004, reconciliations to the group profit

before tax gave rise to a net expense, which increased

in 2005 by euro 227 million. This was primarily

due to the fair value loss on the exchangeable bond

option relating to the BMW Group investment in

Rolls-Royce plc, London.

Financial position

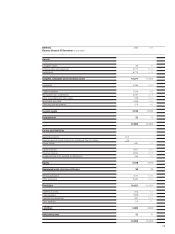

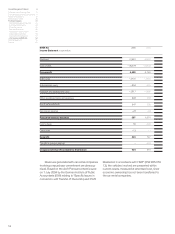

The group cash flow statement shows the sources

and applications of cash flows for the financial

years 2005 and 2004, classified into cash flows

from operating, investing and financing activities.

Cash flows from operating activities are deter-

mined indirectly starting with the group net profit.

By contrast, cash flows from investing and financial

activities are based on actual payments and receipts.

Cash and cash equivalents in the cash flow state-

ment correspond to those disclosed in the balance

sheet.

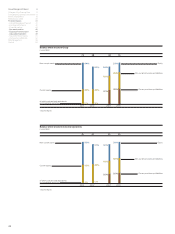

Operating activities of the BMW Group gen-

erated a positive cash flow of euro 10,691 million in

2005, an increase of euro 1,380 million or 14.8%

compared to the previous year. Changes in net cur-

rent assets during 2005 generated a cash inflow of

euro 923 million (2004: euro 222 million). Unlike in

the previous year, the change in inventories gave rise

to a cash inflow.

The cash outflow for investing activities, at euro

11,963 million, was similar to the previous year’s

level. The cash outflow for net investments in finan-

cial services activities rose again steeply and was

euro 1,174 million higher than in the previous year.

Capital expenditure for intangible assets and prop-

erty, plant and equipment resulted in the cash out-

flow for investing activities decreasing by euro 368

million compared to the previous year. In addition,

payment of the final sales price instalment relating

to the sale of Land Rover increased cash inflow by

euro 1,000 million.

Financing activities in 2005 generated a posi-

tive cash flow of euro 699 million (2004: euro 3,137

million). The dividend payment in 2005 increased by

6.9% to euro 419 million. The share buy-back pro-

gramme involved a cash outflow in 2005 of euro

506 million.

89.4% (2004: 77.9%) of the cash outflow for

investing activities was covered by the cash inflow

from operating activities.

The cash flow statement for industrial opera-

tions shows that the cash inflow from operating

activities exceeded the cash outflow from investing

activities by 150.7% (2004: 49.6%). By contrast,

the cash flow statement for financial operations

shows that the cash inflow from operating activities

fell short of the cash outflow from investing activities

by 52.5% (2004: 59.8%).

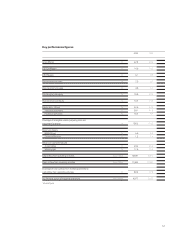

After adjustment for the effects of exchange-

rate fluctuations and changes in the composition of

the BMW Group amounting to positive amount of

euro 66 million (2004: negative amount of euro

22 million), the various cash flows resulted in a de-

crease in group cash and cash equivalents of euro

507 million (2004: increase of euro 469 million). An

amount of euro 43 million included in cash and cash

equivalents was assigned to DeutscheTreuinvest

Stiftung as collateral in conjunction with obliga-

tions for employees’ pre-retirement part-time work

arrangements.

Net interest-bearing assets relating to industrial

operations

(including receivables from the financial

operations sub-group) amounted to euro 4,877 mil-

lion at 31 December 2005, an increase of euro

2,245 million compared to one year earlier. Net inter-

est-bearing assets relating to industrial operations

comprise cash and cash equivalents (euro 1,372 mil-

lion), marketable securities relating to industrial