BMW 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

gleaned from these procedures allows on-going

comparison between dynamic multi-period targets

and periodic performance. Project and periodic

planning are therefore interlinked, thus ensuring that

individual project targets are taken into account

throughout, including in the process of operational

periodic management.

Earnings performance

The BMW Group recorded a net profit of euro 2,239

million for the financial year 2005. After adjusting

the previous year’s figures for the effect of the change

in accounting policy for pension obligations, the net

profit was at a similar level to 2004 (euro 2,242 mil-

lion). The post-tax return on sales was 4.8 % (2004:

5.1%). The group therefore generated earnings per

share of common stock of euro 3.33 and earnings

per share of preferred stock of euro 3.35, both un-

changed from the previous year.

Group revenues rose by 5.2% compared to the

previous year. Unlike in the previous year, exchange

rates only had a small impact on the change in re-

ported group revenues. Revenues from the sale of

BMW, MINI and Rolls-Royce brand cars went up by

2.3%, with product mix shifts affecting in particular

the change in revenues reported by the Automobiles

segment. Revenues from motorcycles business

grew by 19.1% as a result of sales volume factors.

The increase in revenues was helped above all by

the introduction of new models in conjunction with

the Motorcycle segment’s new product initiative.

Revenues from financial services business grew

by 18.2%, also as a result of volume growth. Rev-

enues from other activities of the Group amounted

to euro 119 million and related mainly to the softlab

Group. The comparable figure for 2004 was euro

85 million.

Revenue trends were inconsistent from region

to region. Whereas group revenues decreased in

Germany by 8.0 %, they increased in the rest of

Europe by 9.1%. Revenues for the Americas region

rose by 8.6%. For the markets in Africa, Asia and

Oceania, they grew in total by 15.7%, mainly on

the back of sales volume increases in specific Asian

markets.

Group cost of sales went up 0.5 percentage

points faster than revenues. This development

reflected the impact of additional costs which the

BMW Group has reported on since the beginning

of 2005, namely the effect of less favourable ex-

change rates than in the previous year and higher

raw material prices. Despite these adverse factors,

gross profit increased in absolute terms by 3.6%,

giving a gross profit percentage of 22.9% (2004:

23.2%). The gross profit percentage for industrial

operations was 1.0 percentage points lower than in

the previous year and that for financial operations

was down by 0.5 percentage points. Information

about the composition of these sub-groups is pro-

vided in Note [1].

Sales and administrative costs increased by

2.5% due to the higher level of business volumes;

Group Management Report 8

A Review of the Financial Year 8

The General Economic Environment 11

Review of operations 15

BMW Stock in 2005 38

Financial Analysis 41

--Internal Management System 41

--Earnings performance 42

--Financial position 45

--Net assets position 46

--Subsequent events report 49

--Value added statement 49

--Key performance figures 51

--Comments on BMW AG 52

Risk Management 56

Outlook 60

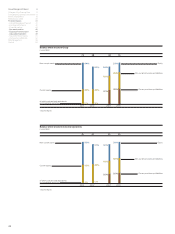

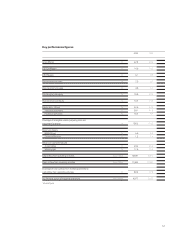

Key performance indicators 2005 2004* 2003 2002 2001

in %

Return on Capital Employed

Automobiles 23.2 25.4 23.8 30.1 32.7

Motorcycles 17.8 10.4 16.7 22.3 22.1

Return on Assets

Financial Services 1.3 1.4 1.4 1.4 1.3

BMW Group 5.6 6.5 6.6 7.6 9.0

*adjusted for new accounting treatment of pension obligations