BMW 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205

|

|

105

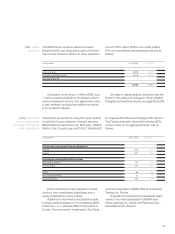

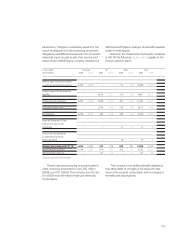

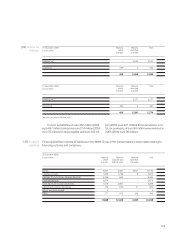

The defined benefit plans of the BMW Group

gave rise to an expense from pension obligations

in the financial year 2005 of euro 397 million (2004:

euro 404 million), comprising the following compo-

nents:

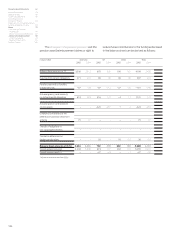

The expense from reversing the discounting

of pension obligations and the income from the ex-

pected return on plan assets are reported as part

of the financial result. All other components of pen-

sion expense are included in the relevant costs by

function in the income statement.

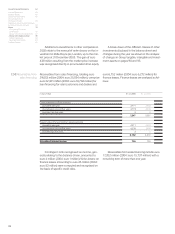

The actual return from external pension funds

was euro 707 million (2004: euro 536 million). The

variance compared to the expected return and the

actual return in the previous year was attributable

mainly to the fact that, particularly in the United King-

dom, pension fund assets generated a higher return

than planned as a result of the recovery of the inter-

national capital markets.

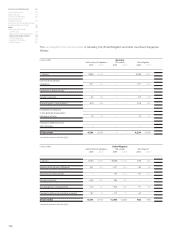

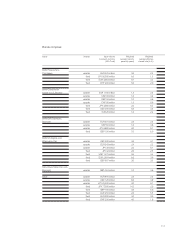

The level of the pension obligations differ de-

pending on the pension system applicable in each

country. Since the state pension system in the

United Kingdom only provides a basic fixed amount

benefit, retirement benefits are largely organised in

the form of company pensions and arrangements

financed by the individual. The pension benefits in

Great Britain therefore contain contributions made

by the employee.

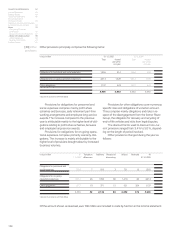

*adjusted in accordance with Note [8] (b)

in euro million Germany UK Other Total

2005 2004*2005 2004*2005 2004*2005 2004*

Current service cost 120 91 53 54 25 31 198 176

Expense from reversing the

discounting of pension obligations 151 132 308 303 23 15 482 450

Past service cost – 49 –––––49

Expected return on plan

assets (–) – –– 271 – 261 –12 –10 – 283 – 271

Expense from pension

obligations 271 272 90 96 36 36 397 404