BMW 2005 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

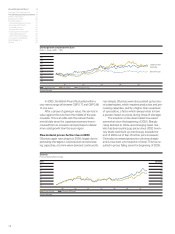

However, the price of a roll of cold-rolled steel, at

US dollar 550, is still around 20 % higher than in the

previous year.

By contrast, the rise in prices of precious metals

continued unabated. Here also, increases in demand

from the Asian region have helped to drive up prices.

A further factor is that raw materials are increasingly

being seen as an alternative form of investment at

a time of global cash flow surpluses and related low

interest rates.

Automobile markets in 2005

Worldwide demand for cars increased moderately

in 2005 compared to the previous year. Within this

overall development, however, the growth rates of

three main traditional markets (Japan, the USA and

Western Europe) fell well short of those for South

East Asia and Latin America.

The total number of cars (light vehicles) sold in

the USA stagnated in 2005 at 16.9 million units.

Although sales in the summer months increased

sharply due to massively extended purchase incen-

tives offered by US manufacturers, this was only just

sufficient to offset the shortfall in unit sales in the

preceding and subsequent months. Despite these

measures, the market share held by US manufacturers

continued to decline in 2005.

The number of cars sold in Western Europe

was static and thus, at approximately 14.5 million,

remained almost unchanged from the previous year.

Whilst Germany (+2.3%) and France (+2.7%) were

able to register somewhat faster growth rates again

in 2005, the Spanish market was more modest,

growing by just 0.8%. By contrast, the number of

cars sold in Italy fell by 1.3% and in the United King-

dom the reduction was as much as 5%.

Since their admission to the EU in May 2004,

the car markets in the new member states have had

to cope with higher prices and an increased volume

of imported used cars. Thereafter, the upturn pre-

viously experienced by those markets has come to

an end, with some of them even suffering severe

declines in 2005.

On the other hand, the Russian car market again

experienced robust growth in 2005, registering a

growth rate of approximately 10 %.

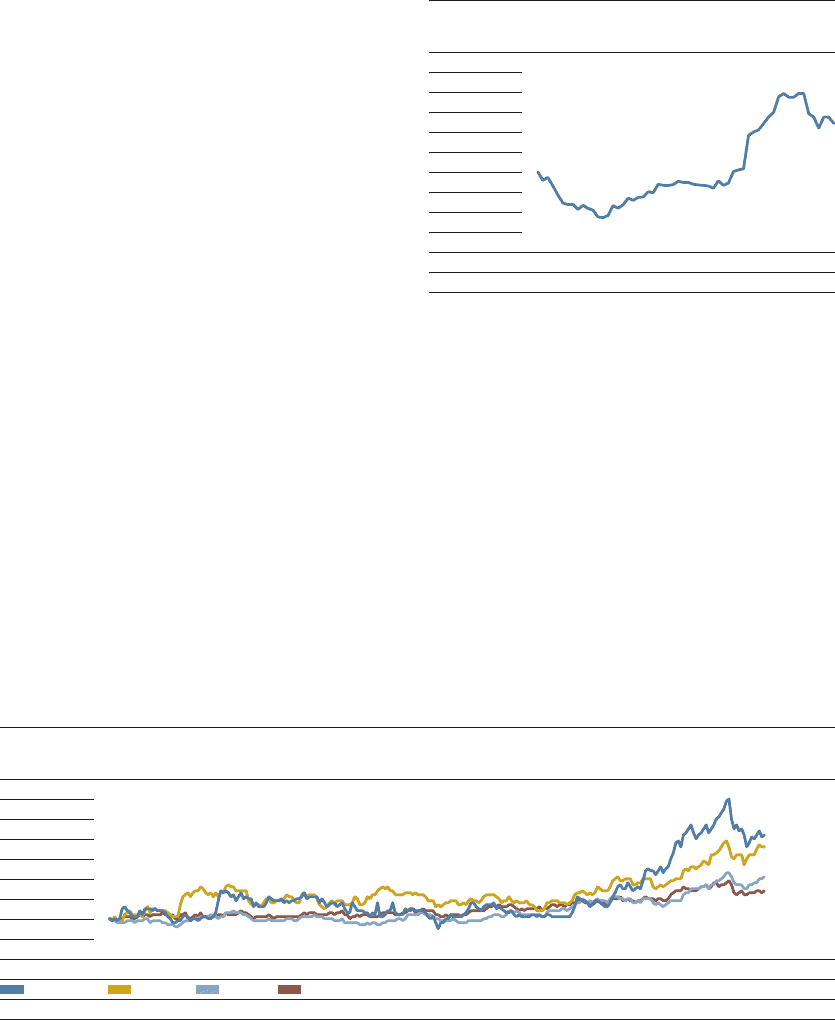

Steel price trend

(Index: January 2001= 100)

150

140

130

120

110

100

90

80

70

01

Source: German Federal Statistical Agency

02 03 04 05

Precious metals price trend in 2005

(Index: 3 January 2005 = 100)

160

150

140

130

120

110

100

90

Jan. Feb. Mar. Apr. May June July Aug. Sept. Oct. Nov. Dec.

Palladium

Palladium

Silver

Platinum

Gold

Silver Gold Platinum

Source: Reuters