BMW 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

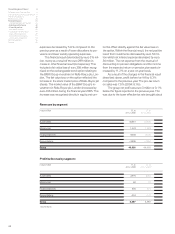

Analysis of the Group Financial Statements

Group internal management system

The underlying objective of BMW Group’s internal

management system is to increase the value of the

Group as a whole. The targets set for the Automo-

biles, Motorcycles and Financial Services segments

all stem from this objective. Within the Automobiles

and Motorcycles segments, this approach is put into

practice for specific product, process and structure-

related projects. By contrast, the Financial Services

segment is primarily concerned with the cash flows

resulting from its credit and lease portfolio.

The strategies set for each line of business and

related project decisions give rise to strategic em-

phases which are then implemented at a functional

level. The overall project development process be-

comes more targeted as a result of the closer link

between strategies defined for lines of business

and objectives defined for specific projects. Once

a project decision has been reached, the task is to

manage each individual project over time. Projects

are therefore observed and resources reallocated,

where necessary, according to priorities.

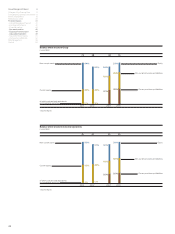

The project decision and related project selec-

tion are therefore important aspects of the value-

based planning process of the BMW Group. Net

present values (NPVs) and rates of return are com-

puted as part of the decision-making process: this

involves computing the present value of cash flows

and the internal project rate of return (or model rate

of return in the case of vehicle projects) which are

expected to be generated by a project decision.

The discount rate used in these computations is

the group-specific minimum required rate of return

derived from the capital market (weighted average

cost of capital). Using this method, the amount by

which a project will contribute to the total value of

the segment (i.e. the project’s value-added) can

be documented at the same time that the project

decision is taken. Targets and performance are con-

trolled using project-related target NPVs and indi-

vidual cash flow related parameters which have an

impact on those values.

The NPV of a project programme is computed

by aggregating the amounts for all projects and

discounting them back to a specific date; this value

serves as the main target for the Automobiles and

Motorcycles segments. The business value of each

segment is then computed by deducting the fair

value of debt capital. For both of these segments,

the objective is to increase business value, as com-

puted above, on a continuous basis.

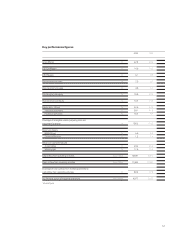

The management of product projects and of

the product programme as a whole described above

is subject to basic conditions which result from

periodic planning. The aim here is to monitor and

manage periodic targets on a long-term basis.

Periodic performance is managed in the light of

defined accounting policies and external financial

reporting requirements. The BMW Group primarily

uses profit before tax and segment-specific rates

of return as the key indicator figures by which it

manages operating performance. For example,

return on capital employed is used as the main per-

formance parameter of the Automobiles and Motor-

cycles segments. Return on sales is also used as

a measurement basis. In the case of the Financial

Services segment and the Group as a whole, the

return on assets is used. The overall target set

for earnings is continuous growth; the minimum

rate of return required for each line of business is

used as the relevant parameter. These periodic tar-

gets are supplementary to project and programme

targets.

In order to implement this comprehensive target

and management system, whilst at the same time

satisfying periodic reporting and accounting require-

ments, the model analyses for each project decision

reached the impact of cash flows on both the NPV

and the model rate of return, as well as the impact

on earnings. This approach enables the BMW Group

to analyse the effect of each project-based decision

on business value (quantified in terms of the NPV

of the project programme) as well as on earnings

and rates of return. “Multi-project planning” data