BMW 2005 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.118

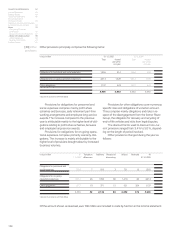

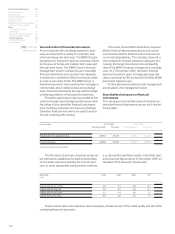

euro1,072 million) on cash flow hedges and of euro

562 million (2004: euro 62 million) on available-for-

sale securities.

During the year under report, net fair value losses

of euro 543 million (2004: euro 420 million) were

recognised directly in equity, comprising fair value

losses of euro1,043 million on cash flow hedges

(2004: euro 628 million) and fair value gains of euro

500 million (2004: euro 208 million) on available-

for-sale securities.

In the financial year under report, fair value gains

of euro 661 million (2004: euro 942 million) were

removed from other accumulated equity and re-

alised during the year. Write-downs of euro10 million

(2004: euro11 million) on available-for-sale securi-

ties, for which fair value changes were previously

recognised directly in equity, were recognised as

expenses in 2004. Reversals of write-downs on cur-

rent marketable securities of euro 3 million were

recognised directly in equity (2004: euro 6 million

recognised as income). In 2005, gains of euro 33 mil-

lion (2004: euro 4 million) were realised on the dis-

posal of available-for-sale securities and the equiva-

lent amount removed from other accumulated

equity and recognised in the income statement.

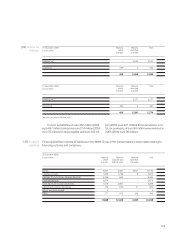

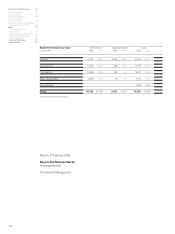

The cash flow statements show how the cash and

cash equivalents of the BMW Group, industrial oper-

ations and financial operations have changed in the

course of the year as a result of cash inflows and

cash outflows. In accordance with IAS 7 (Cash Flow

Statements), cash flows are classified into cash

flows from operating, investing and financing activi-

ties. The cash flow statements of the BMW Group

are presented on pages 66 and 67.

Cash and cash equivalents included in the cash

flow statement comprise cash in hand, cheques

and

cash at bank, to the extent that they are available

within three months from the balance sheet date

and are subject to an insignificant risk of changes in

value. The negative impact of changes in cash and

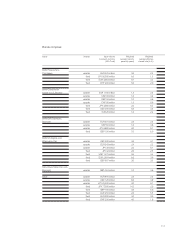

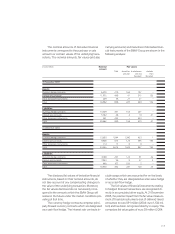

Credit risk

Financial assets are recognised in the balance sheet

net of write-downs for the risk that counter-parties

are unable to fulfil their contractual obligations, irre-

spective of the value of collateral received. Depend-

ing on the nature and amount of exposure entered

into, collateral will be required, information on the

credit-standing of the counter-party obtained or his-

torical data based on the existing business relation-

ship (i.e. payment patterns to date) reviewed in order

to minimise the credit risk relating to performance

relationships underlying non-derivative financial in-

struments. Write-downs are recorded as soon as

credit risks are identified on individual financial assets.

This credit risk is minimised by the fact that the

Group only enters into such contracts with parties

of first-class credit standing. The general credit risk

on derivative financial instruments utilised by the

BMW Group is therefore not considered to be sig-

nificant. A concentration of credit risk with particular

borrowers or groups of borrowers has not been

identified.

cash equivalents due to the effect of exchange rate

fluctuations in 2005 was euro 60 million (2004: euro

23 million).

The cash flows from investing and financial ac-

tivities are based on actual payments and receipts.

The cash flow from operating activities is computed

using the indirect method, starting from the net

profit of the Group. Under this method, changes in

assets and liabilities relating to operating activities

are adjusted for currency translation effects and

changes in the composition of the Group. The

changes in balance sheet positions shown in the

cash flow statement do not therefore agree directly

with the amounts shown in the Group balance

sheet.

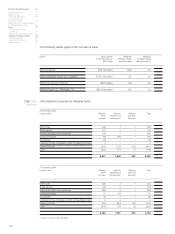

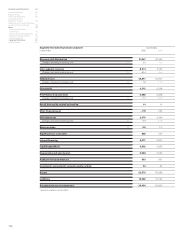

[40]Explanatory

notes to the

cash flow statements

Group Financial Statements 62

Income Statements 63

Balance Sheets 64

Cash Flow Statements 66

Group Statement of

Changes in Equity 68

Statement of Income and Expenses

recognised directly in Equity 69

Notes 70

--Accounting Principles

and Policies 70

--Notes to the Income Statement 81

--Notes to the balance sheet 90

--Other Disclosures 114

--Segment Information 121

Auditors’ Report 125