BMW 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

NAFTA region fell by one percentage point during

the same period, mainly due to the higher produc-

tion volume (and therefore higher purchase volume)

in Europe, whilst the production volume of the

BMW Spartanburg plant was down on the previous

year. Purchases in the other regions changed in line

with production volume growth and therefore re-

mained unchanged in percentage terms compared

to the previous year.

Raw material markets under strain

The high price levels on the raw material markets

were particularly important for the Group’s purchas-

ing departments in 2005. Significantly higher costs

had to be taken on board for supplies of steel and

plastic. As an example, the average price of cold-

rolled sheet steel increased by approximately 20%

compared to 2004. Industrial raw materials went

up by 12% in US dollar terms and by 13% in euro

terms. The price of non-precious metals increased

by 14% in both US dollar and euro terms. A major

development was the increase, particularly in the

final quarter 2005, in the price of energy-related raw

materials, especially crude oil, which serves as the

basis for plastics. Compared to 2004, the purchase

price of these materials increased on average by

around 36%.

In the case of precious metals (rhodium, palla-

dium, platinum), purchase price hedges held down

the impact of market price increases for the BMW

Group. As far as other raw materials were con-

cerned, measures were put in place to ensure that

additional costs were fairly spread over the entire

added-value chain, with the BMW Group also bear-

ing its share of these costs. Although purchase

price predictions carried out since the year-end

show that the commodity markets may have eased

somewhat, it is likely that high price levels will per-

sist in 2006.

Working with suppliers to improve

competitiveness

The external share of the added-value chain is

currently in the range of 70 to 80 percent; working

closely with suppliers to improve products and

processes is therefore a critical factor for success.

The BMW Group initiated a joint project with sup-

pliers back in 2004 with a view to working together

to reduce product costs. This initiative was expand-

ed in 2005 and now incorporates measures to im-

prove the reliability of bought-in components and

systems.

By considering all potential opportunities along

the whole chain from the procurement market

through to the dealer, the aim is to reduce costs of

the current models, whilst at the same time improv-

ing field quality after vehicles have been delivered

to customers. Insights gained in this way subse-

quently flow into the development of new vehicles.

New supplier management system

The objective of the “Management of Partner Net-

works” project was to extract full benefit from the

innovative strength of the procurement market; the

“New Supplier Management” project was launched

at the beginning of 2005 in order to complement

this project.

The focus is on optimising internal processes

within the BMW Group at the crucial interfaces

between development, purchasing, production and

sales. By adopting concurrent engineering methods

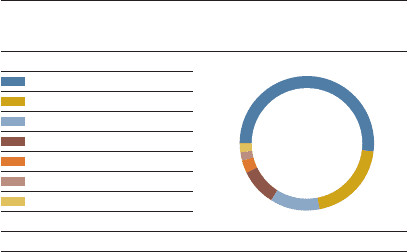

Regional mix of BMW Group purchase volumes 2005

in %, basis: production material

Germany

Rest of Western Europe

NAFTA

Central and Eastern Europe

Africa

Asia/Australia

South America 9

12

3

2

2

20

52