BMW 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 BMW annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205

|

|

110

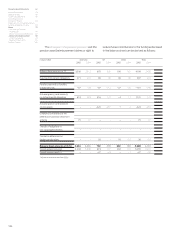

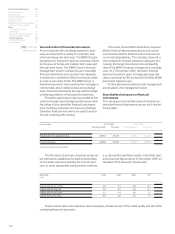

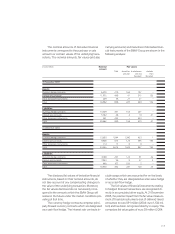

Bonds include an exchangeable bond of euro

561 million issued on 4 December 2003 relating to

the investment of the BMW Group in the engine

manufacturer Rolls-Royce plc, London. This bond is

subject to an annual interest rate of 1.875% and has

a term of five years. After three years into the term,

the Group has the right, up to the maturity date, to

give notice on the bond if Rolls-Royce stock rises to

a level of more than 130% of the exchange price of

GBP 2.46. A cash-out option is also in place giving

the Group, in the event that the exchange right is

exercised, the right to make a payment equivalent to

the market price of the stock at that date, rather than

to deliver the stock itself. The present value of the

bond at the balance sheet date, including transac-

tion

costs, was euro 519 million (2004: euro 506 mil-

lion).The related option liability is included at 31De-

cember

2005 in financial liabilities at its fair value

of euro 452 million (2004: euro 96 million). The

negative change in the fair value of the option lia-

bility, amounting to euro 356 million, is recognised

as an expense in the line “Other financial result”.

Other financial liabilities of euro 896 million

(2004: euro 881 million) comprise mainly finance

lease liabilities.

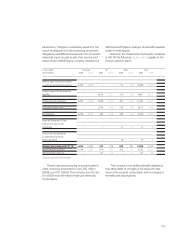

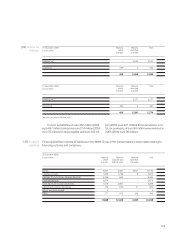

31 December 2004*

in euro million Maturity Maturity Maturity Total

within between one later than

one year and five years five years

Bonds 2,877 6,225 3,346 12,448

Liabilities to banks 1,989 1,598 203 3,790

Liabilities from customer deposits (banking) 4,878 223 – 5,101

Commercial paper 4,059 – – 4,059

Asset backed financing transactions 1,116 3,153 - 4,269

Interest and currency derivatives 237 120 25 382

Bills of exchange payable 1 – – 1

Other 107 393 381 881

15,264 11,712 3,955 30,931

*adjusted in accordance with Note [8] (a)

Group Financial Statements 62

Income Statements 63

Balance Sheets 64

Cash Flow Statements 66

Group Statement of

Changes in Equity 68

Statement of Income and Expenses

recognised directly in Equity 69

Notes 70

--Accounting Principles

and Policies 70

--Notes to the Income Statement 81

--Notes to the balance sheet 90

--Other Disclosures 114

--Segment Information 121

Auditors’ Report 125